Introduction

Introducing RupeeHub app, the instant personal loan online App designed to make borrowing money quick and easy. With just your mobile phone number and basic information, you can apply for a loan in no time. The app offers flexible loan amounts ranging from ₹2,000 to 20,000, with varying tenures of 91 to 365 days. Interest rates are based on your risk profile and loan tenure, with rates starting from 20% per annum. With fast and intelligent reviews, your loan can be approved within minutes, and the funds will be deposited into your account in just five minutes. With a variety of products available, the app aims to meet the borrowing needs of different customers, making dreams of buying a car or a house a reality. With the option for repayment in installments, the app ensures a simple and stress-free borrowing process. Experience fast and secure lending services with the app today.

Features of RupeeHub:

⭐ Fast borrowing: The app makes the loan process quick and hassle-free. With a low threshold, all you need to do is register your mobile phone number, fill in some basic information, and apply for a loan. This means you can access much-needed funds in a matter of minutes, without the stress and delay of traditional loan applications.

⭐ Fast review: To ensure a speedy process, the app utilizes intelligent review methods. Once your application is submitted and reviewed, if it meets the criteria, you can expect to receive your loan within five minutes. This means you don't have to wait for days or weeks to get the funds you need.

⭐ Flexible quotas: The app understands that every customer's borrowing needs are unique. That's why they offer a variety of loan products to cater to different financial requirements. Whether you need to buy a car, make a down payment on a house, or cover personal expenses, the app has a loan option that suits your specific needs.

⭐ Diversified products: Collaboration with multiple financial institutions sets the app apart from other lending apps. This partnership ensures that you can enjoy fast and secure lending services, knowing that you're working with trusted and reputable institutions. With the app, you can have peace of mind while borrowing.

Tips for Users:

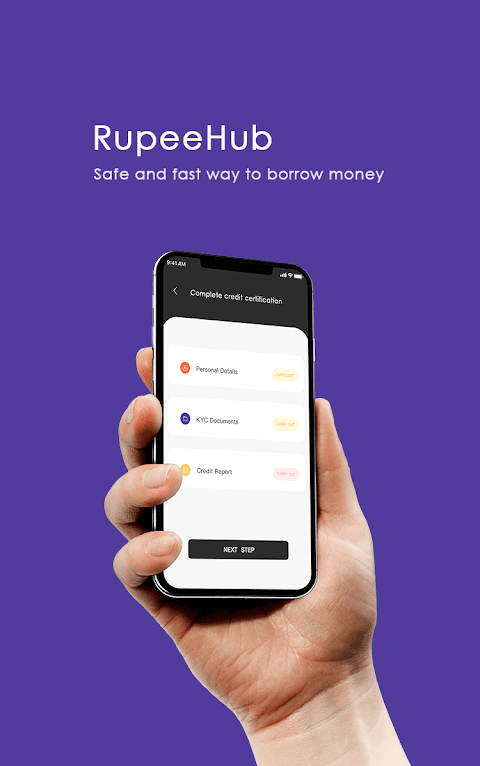

⭐ Complete your profile: To ensure a smooth and quick loan process, it's important to provide accurate and complete information when registering on the app. This includes details such as your name, address, income, and employment information. The more comprehensive and accurate your profile, the higher your chances of loan approval.

⭐ Choose the right product: Take your time to explore the range of loan products available on the app. Consider your specific borrowing needs, repayment capabilities, and interest rates. By choosing the right loan product, you can optimize your borrowing experience and ensure a stress-free repayment journey.

⭐ Review the terms and conditions: Before finalizing your loan application, carefully review the terms and conditions provided by the app. Pay attention to interest rates, repayment schedules, and any additional fees or charges. Understanding these details will help you make informed decisions and avoid any surprises down the line.

Conclusion:

With attractive features like fast borrowing, quick review processes, flexible borrowing options, and collaboration with trusted financial institutions, RupeeHub app stands out in the lending market. By following playing tips such as completing your profile accurately, choosing the right loan product, and reviewing the terms and conditions, you can maximize your experience with the app and access the funds you need easily. Don't let financial constraints hold you back, download the app now and experience hassle-free borrowing.

- No virus

- No advertising

- User protection

Information

- File size: 12.30 M

- Language: English

- Latest Version: 1.0.7

- Requirements: Android

- Votes: 492

- Package ID: com.lending.rupeehub

- Developer: Rphub Technologies Private Limited

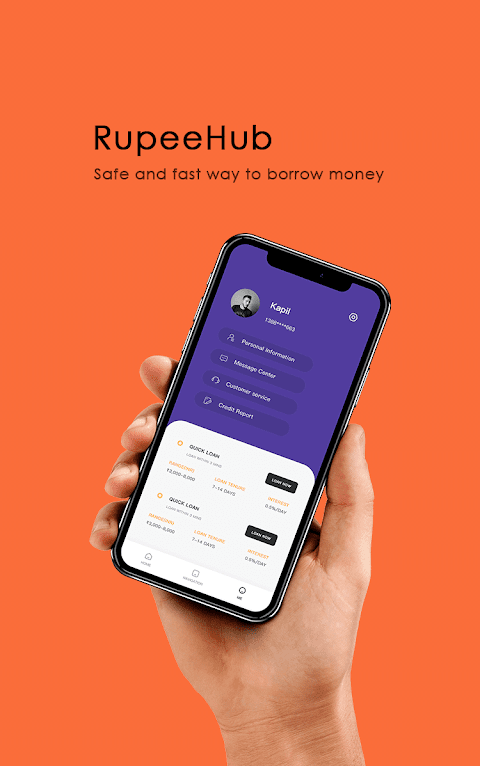

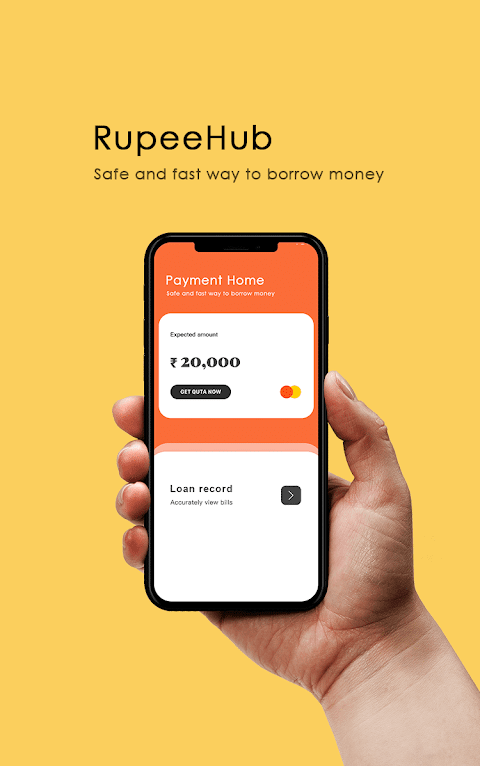

Screenshots

Explore More

Join us now! Explore our carefully curated loan software designed to streamline financial assistance processes. These applications offer tools for loan management, borrower evaluation, and financial tracking, providing comprehensive solutions for both borrowers and lenders.

Make Me Slim - Make Me Tall

Dana Syariah

AR Drawing Anime Sketch Trace

Thirukkural with Meanings

Blended

Color Palette

Sahih Bukhari Shareef

Jazp.com

Comment