Introduction

Need some extra cash urgently? Look no further than the Préstamos Personales Urgentes app! With our app, you can easily apply for a personal loan with a monthly interest rate ranging from 2.5% to 9.7%. Whether you need to borrow for 12, 18, 24, 36, or even 48 months, we've got you covered. Our interest rates are determined by factors such as your credit score, credit usage history, and loan term. Once you accept our loan offer, the funds will be quickly transferred to your bank account after completing the necessary verifications. Don't wait any longer, download the app now and get the money you need in no time!

Features of Préstamos Personales Urgentes:

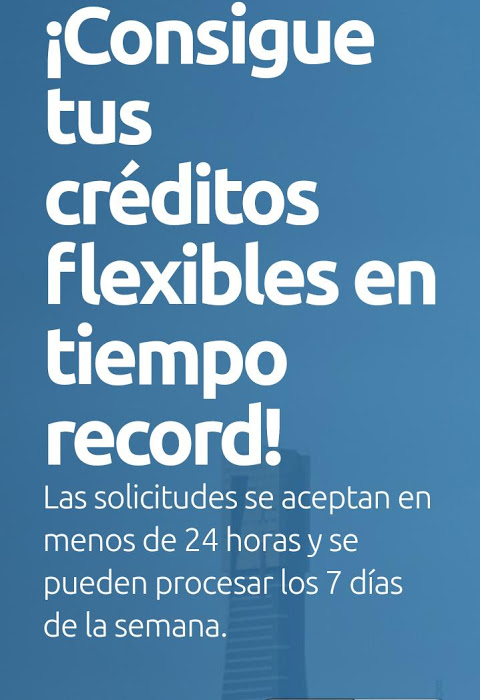

⭐ Quick and Convenient Application Process:

With the app, you can apply for a loan without any hassle. The app provides a simple and streamlined application process, ensuring a quick turnaround time. You can complete the entire process from the comfort of your home, eliminating the need for any physical paperwork or visits to the bank.

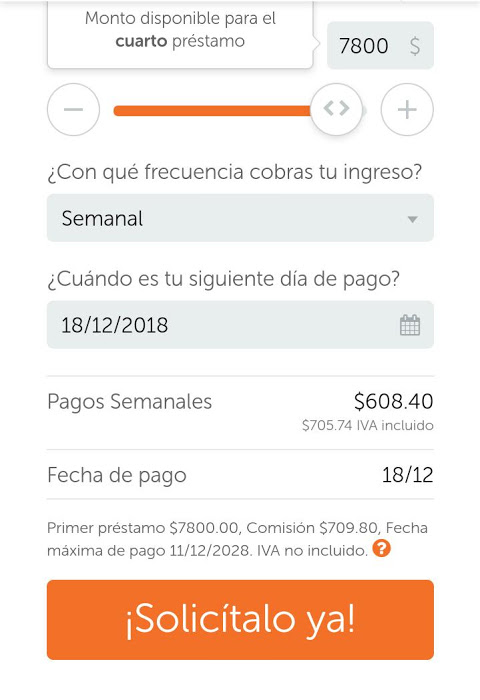

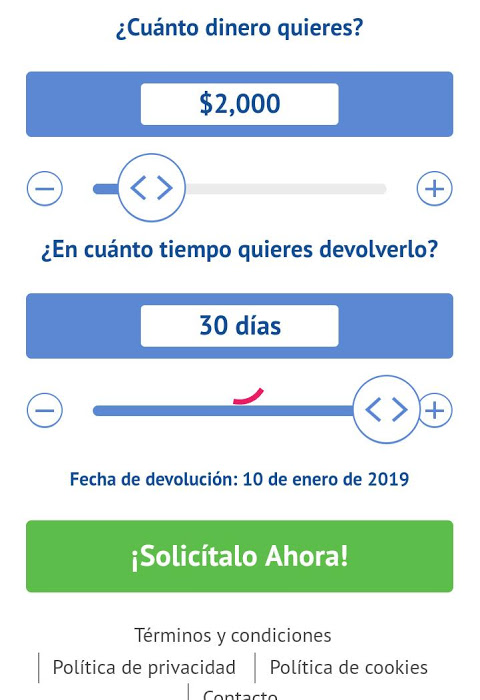

⭐ Flexible and Affordable Loan Options:

This app offers a variety of loan options to cater to different financial requirements. You can choose a term ranging from 12 to 48 months, with loan amounts adjusted to your needs. Moreover, Préstamos Personales Urgentes provides loans at low-interest rates, starting at just 2.5%, making it an affordable choice for borrowers.

⭐ Personalized Interest Rates Based on Creditworthiness:

By using the app, you'll benefit from personalized interest rates. The app considers various factors like your credit score, credit usage history, and loan term to determine the interest rate for your loan. This personalized approach ensures that you receive the most favorable interest rate based on your financial profile.

⭐ Speedy Approval and Disbursement:

Préstamos Personales Urgentes understands the urgency of your financial needs. Once your loan application is approved, the funds will be sent directly to your bank account upon signing the digital contract. While the availability of funds depends on your bank's processing speed, the app ensures a swift and efficient disbursement process.

Tips for Users:

⭐ Maintain a Good Credit Score:

To secure the lowest interest rates and higher loan amounts, it is crucial to maintain a good credit score. Pay your bills on time, manage your credit utilization, and monitor your credit report regularly. This will help you qualify for better terms and conditions when applying for a loan through the app.

⭐ Carefully Choose the Loan Term:

Consider your financial situation and repayment capabilities before selecting a loan term. While a shorter-term may result in higher monthly payments, it can save you money in the long run by reducing the interest paid. On the other hand, a longer term may offer lower monthly payments but ultimately lead to higher interest costs.

⭐ Review the Loan Contract Thoroughly:

Before accepting a loan offer, thoroughly review the loan contract. Understand the terms, interest rates, fees, and any additional charges associated with your loan. By being well-informed, you can make informed decisions, avoid surprises, and confidently proceed with your loan agreement.

Conclusion:

Préstamos Personales Urgentes is a user-friendly app that offers attractive features to meet your urgent financial needs. With a quick and convenient application process, flexible loan options, personalized interest rates, and speedy loan disbursal, this app ensures a smooth borrowing experience. By following the playing tips, such as maintaining a good credit score, choosing the right loan term, and thoroughly reviewing the loan contract, you can make the most out of the app to meet your financial goals. Download the app now and take advantage of its convenient loan services.

- No virus

- No advertising

- User protection

Information

- File size: 9.20 M

- Language: English

- Latest Version: 9.8

- Requirements: Android

- Votes: 331

- Package ID: presta.personalurg

- Developer: Aldisil Apps

Screenshots

Explore More

Explore our comprehensive collection of borrowing software, tailored to enhance financial solutions. These tools encompass diverse functionalities including loan management, borrower assessment, and financial analytics, offering robust support for borrowers and lenders alike.

View more

Comment