Introduction

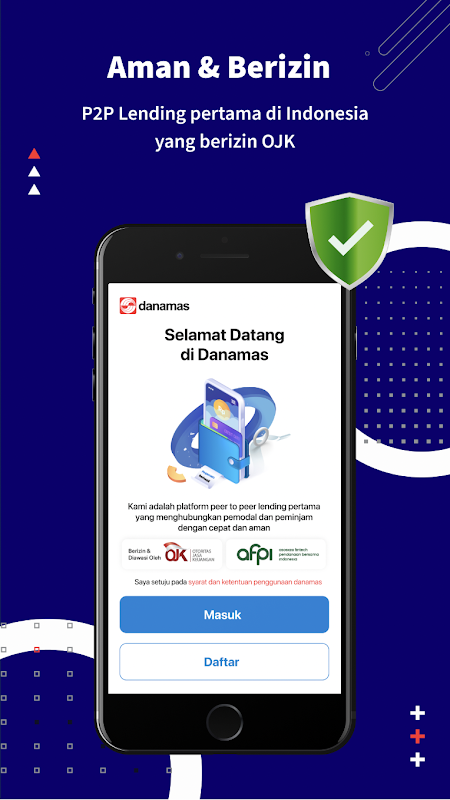

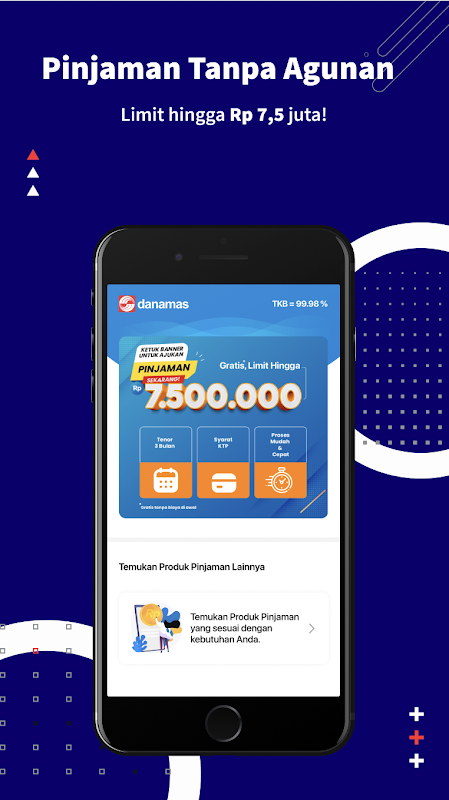

Danamas Peminjam is a trusted and licensed online loan platform offered by PT. Sinarmas Group, a well-known name in the banking sector. With various government licenses and permits, Danamas ensures the security and reliability of its services. Offering cash loans up to IDR 7.5 million with flexible repayment options ranging from 3 to 6 months, Danamas makes borrowing quick and hassle-free. The registration process is simple, requiring only essential documents such as ID, photo, phone number, and email. Once registered, you can apply for a loan with a maximum processing time of 24 hours. With integrated payment methods, settling your loan is convenient and easy. Trust Danamas Peminjam for all your loan needs and experience a seamless borrowing experience.

Features of Danamas Peminjam:

❤ Trusted Online Loans: Danamas has obtained various government licenses and permits, including a business license from the OJK. It is also trusted by KEMKOMINFO and is part of the Indonesian Joint Funding Fintech Association (AFPI).

❤ Cash Fund Loans: Danamas offers online loans with a cash limit of up to IDR 7.5 million. The funds are guaranteed to be disbursed quickly after approval.

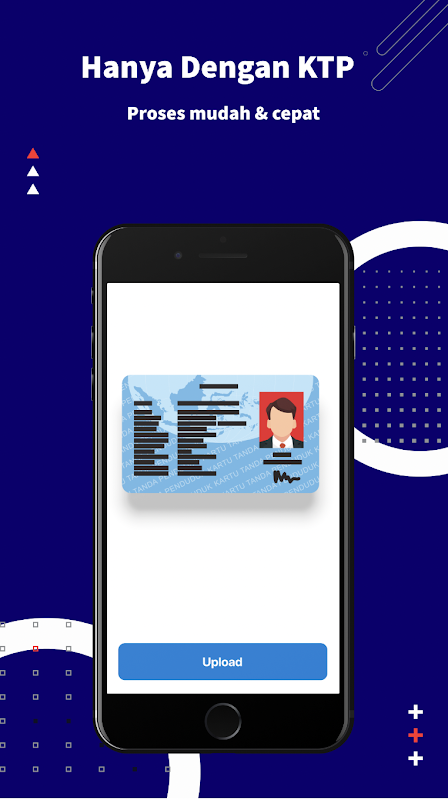

❤ Easy Registration Process: The registration process for Danamas loans is very simple. Applicants only need to provide documents such as KTP, photo, cellphone number, and email to register as a Danamas borrower.

❤ Fast Loan Application: After completing the registration process with the required documents, applicants can immediately apply for a loan. The loan application process takes a maximum of 24 hours.

❤ Integrated Payment Process: The app provides several methods for loan installment payments, including internet banking, mobile banking, teller, and ATM/bank transfer.

FAQs:

❤ What is the maximum loan amount offered by the app?

The app offers cash loans with a limit of up to IDR 7.5 million.

❤ How long does it take for the loan application to be processed?

The loan application process takes a maximum of 24 hours.

❤ What documents are required for registration?

Applicants need to provide documents such as KTP, photo, cellphone number, and email for registration.

❤ What payment methods are available for loan installments?

The app allows loan installments to be paid via internet banking, mobile banking, teller, and ATM/bank transfer.

❤ What government licenses and permits does the app have?

The app has obtained licenses and permits from various government bodies, including the OJK, KEMKOMINFO, and the Indonesian Joint Funding Fintech Association (AFPI).

Conclusion:

Danamas Peminjam is a trusted online loan platform backed by a solid reputation in the banking sector. With various licenses and permits from government bodies, users can feel confident in their transactions. The integrated payment process provides convenience for loan repayment. For those in need of a multifunctional loan, the app is a reliable choice.

- No virus

- No advertising

- User protection

Information

- File size: 29.40 M

- Language: English

- Latest Version: 3.0.13

- Requirements: Android

- Votes: 177

- Package ID: id.co.danamasbor

- Developer: PT Pasar Dana Pinjaman

Screenshots

Explore More

Entertain yourself endlessly on the go for zero cost! Packed with movies, shows, music and videos from around the world, these top-rated media apps will keep you engrossed for hours. Stream your favorite channels and playlists ad-free or download your favorites for offline viewing later. Download now to turn your phone into an unlimited personal theater - and enjoy premium entertainment that won’t drain your budget.

Headify: AI Headshot Generator

Glance for realme

Audify Notification Announcer

Vault-Hide Pics & Videos,App Lock, Free backup

AI Music&Song Maker

Nyah-gruppen

Puneet Superstar Stickers

WFSB

Comment