Introduction

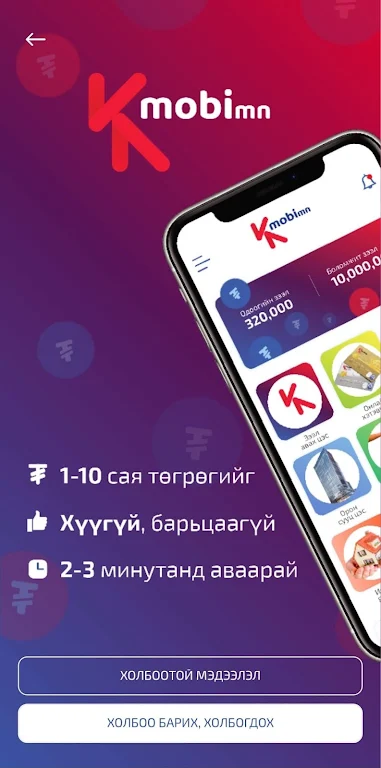

Introducing the Kmobimn app, your ultimate online loan solution for all your everyday needs. With its user-friendly interface and time-saving features, this app is designed to make borrowing money easier than ever before. Whether you need a short-term loan for 75 or 90 days, without any collateral required, or a long-term loan for up to 90 days with a high amount of up to 10,000,000₮, the app has got you covered. Plus, with the option to pay your debts using Q-Pay and the ability to continuously increase your loan amount, this app truly offers convenience at your fingertips. So why wait? Sign up online, activate your account, and start enjoying the benefits of the app today!

Features of Kmobimn:

⭐ User-friendly and Time-saving: Kmobimn is designed to be incredibly user-friendly, ensuring a seamless and convenient experience. With a simple and intuitive interface, you can easily navigate through the loan application process without any hassles. This saves you precious time that would otherwise be wasted on complicated paperwork and unnecessary procedures.

⭐ No Collateral Required: Unlike traditional loan providers, the app does not require any collateral for you to secure a loan. This means that you can get the financial assistance you need without having to pledge any valuable assets. It eliminates the stress and worry associated with collateral-based loans and ensures greater accessibility for all.

⭐ 24/7 Availability: Distance and time will no longer be barriers when it comes to obtaining credit. Kmobimn offers round-the-clock service, allowing you to apply for a loan anytime, anywhere. Whether it's day or night, weekday or weekend, you can access the application and get the financial support you require, making it highly convenient for hectic schedules and urgent needs.

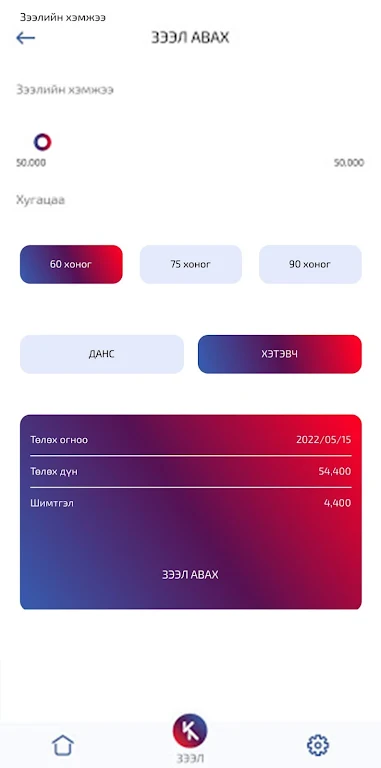

⭐ Long Term Loans: Kmobimn offers the flexibility of long term loan options for its users. With repayment periods of up to 90 days, you have ample time to repay your loan without feeling overwhelmed. This longer duration caters to a wide range of financial needs, allowing you to better manage your repayment strategy and adapt to your specific circumstances.

Tips for Users:

⭐ Familiarize Yourself with the App: Take some time to explore and familiarize yourself with the features and functions of the app. This will enable you to navigate the application smoothly, ensuring a hassle-free experience when applying for a loan.

⭐ Activate and Set Up Your Account: To access loan services via messages, it is essential to sign up online and activate your account. This step ensures that you can freely avail loaning services through messages, making the process even more convenient for you.

⭐ Calculate and Plan Your Repayment: Before applying for a loan, it is crucial to calculate the amount you need and plan your repayment strategy. By determining the repayment period that suits you best, you can ensure timely repayments and avoid any potential penalties or complications.

Conclusion:

Kmobimn is the perfect solution for your everyday financial needs. With its user-friendly interface, no collateral requirement, and 24/7 availability, it offers unrivaled convenience and accessibility. The flexibility of long term loans further enhances its attractiveness, allowing borrowers to manage their repayments effectively. By following the playing tips of familiarizing yourself with the app, activating your account, and planning your repayment, you can maximize your experience with the app. Don't wait any longer - click, download, and unlock the financial support you need with the app.

- No virus

- No advertising

- User protection

Information

- File size: 60.90 M

- Language: English

- Latest Version: 3.0.0

- Requirements: Android

- Votes: 230

- Package ID: com.kmobi

- Developer: Central Capital

Screenshots

Explore More

Explore our comprehensive collection of borrowing software, tailored to enhance financial solutions. These tools encompass diverse functionalities including loan management, borrower assessment, and financial analytics, offering robust support for borrowers and lenders alike.

View more

Comment