Introduction

Introducing the 신한저축은행 모바일대출 - 스마트금융 app, your convenient and accessible solution for applying for loans anytime, anywhere. With this app, you can explore and find the perfect loan product from Shinhan Savings Bank that suits your needs. The integrated limit inquiry feature will guide you in making the right decision. Applying for a loan is made easy with the option to submit your documents electronically, saving you time and effort. The app also provides a seamless loan execution process, including electronic contracts and progress inquiries. For existing customers, you can manage your loan accounts, repay principal and interest, issue certificates, and update personal information through the My Page loans section. Don't miss the opportunity to experience the convenience and efficiency of the app.

Features of 신한저축은행 모바일대출 - 스마트금융:

> 24/7 Accessibility: 신한저축은행 모바일대출 - 스마트금융 allows users to apply for a loan anytime, anywhere. This convenience makes it easy for users to access financial services whenever they need them.

> Integrated Limit Inquiry: The app provides information on various loan products offered by Shinhan Savings Bank. Through integrated limit inquiry, users can find the loan product that best suits their needs.

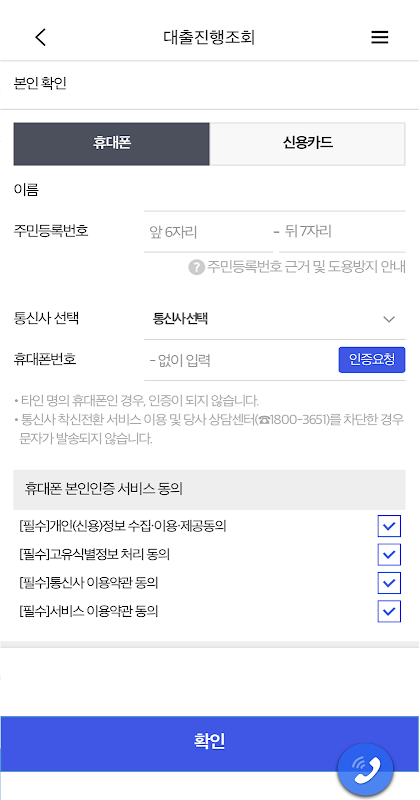

> Electronic Document Submission: The app allows users to submit their ID card and employment/income documents electronically when applying for a loan. This eliminates the hassle of submitting physical documents and streamlines the loan application process.

> Electronic Contract and Progress Inquiry: Users can execute the loan through electronic contract and track the progress of their loan application through the app. This feature provides transparency and updates on the status of the loan.

> My Page Loan Management: For customers using My Page loans, the app provides a range of convenient features. Users can check their loan account, repay principal and interest, issue certificates, change automatic transfer accounts, and edit their personal information.

> Competitive Loan Terms: Shinhan Savings Bank offers a variety of loan products with competitive interest rates and flexible repayment options. Users can choose the loan amount, repayment period, and repayment method that best fits their financial situation.

FAQs:

> How can I access the 신한저축은행 모바일대출 - 스마트금융 app?

To access the app, simply download it from the Google Play Store. If the app does not run properly, make sure to install and run the "V3 Mobile Plus" app from the Google Play Store.

> Can I apply for a loan outside of the bank's operating hours?

Yes, 신한저축은행 모바일대출 - 스마트금융 allows users to apply for a loan 24 hours a day, 7 days a week.

> What documents do I need to submit when applying for a loan?

When applying for a loan, you can submit your ID card and employment/income documents electronically through the app. This eliminates the need for physical document submission.

> How can I track the progress of my loan application?

The app provides a progress inquiry feature that allows users to track the status of their loan application.

> Can I manage my existing loans through the app?

Yes, for customers using My Page loans, the app provides loan management features such as checking loan accounts, repaying principal and interest, issuing certificates, changing automatic transfer accounts, and editing personal information.

Conclusion:

신한저축은행 모바일대출 - 스마트금융 offers a convenient and accessible solution for users who need financial assistance. With 24/7 accessibility, integrated limit inquiry, electronic document submission, electronic contract and progress inquiry, and My Page loan management features, the app provides a seamless and transparent loan application process. Moreover, the competitive loan terms offered by Shinhan Savings Bank ensure that users have a variety of options to choose from that best suit their financial needs. Download the app now and experience the convenience of the app.

- No virus

- No advertising

- User protection

Information

- File size: 69.90 M

- Language: English

- Latest Version: 2.0.13

- Requirements: Android

- Votes: 249

- Package ID: com.shinhan.smartloan

- Developer: 신한저축

Comment