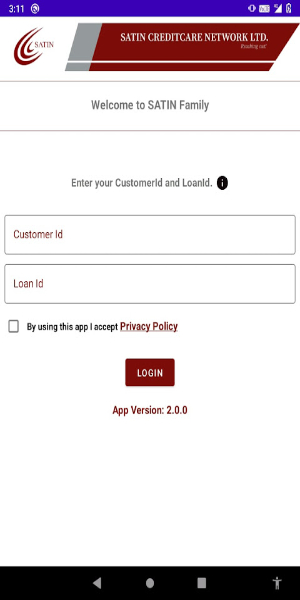

Introduction

Satin Creditcare Network Ltd. is a comprehensive financial app that empowers users with easy UPI payments, detailed loan management, and convenient loan card features. Users can access loan details, manage repayments, and handle weekly collections effortlessly, making financial management straightforward and accessible for everyone.

Unlocking Financial Empowerment with Satin Creditcare Network Ltd.

Satin Creditcare Network Ltd. (SCNL) stands as a pioneering force in India’s microfinance sector. Established in 1990 by visionary entrepreneur HP Singh, SCNL has evolved into a prominent Non-Banking Financial Company (NBFC) specializing in microfinance. Achieving a milestone by crossing $1 billion in assets under management in FY19, SCNL is now a distinguished member of the elite Billion Dollar Group. Registered with the Reserve Bank of India (RBI) as an NBFC – Microfinance Institution (MFI) in 2013, SCNL has consistently dedicated itself to empowering the underserved segments of society through comprehensive financial solutions.

Our Mission and Vision

Mission: SCNL is committed to enhancing the lives of households traditionally excluded from mainstream financial services. Our mission is to provide crucial financial assistance that improves livelihoods and fosters a productive environment for the economically active, particularly in rural and semi-urban areas.

Vision: Our vision is to be the go-to solution for financially excluded households at the bottom of the pyramid. We aspire to be a financial service powerhouse, offering a diverse range of tailored financial products that cater specifically to the needs of this community.

Diverse Product Suite

SCNL offers a broad array of financial products designed to meet the unique needs of its clients. From income generation loans to housing finance, our products are crafted to support economic activities that enable borrowers to build assets, generate cash flows, and achieve self-reliance. Our offerings include:

Income Generation Loans: These loans are instrumental in supporting various economic activities, helping individuals increase their income and financial stability.

MSME Loans: Targeted at micro, small, and medium enterprises to foster business growth and sustainability.

Housing Finance: Facilitates access to affordable housing loans, enabling families to secure better living conditions.

Easy UPI Payments

SCNL leverages technology to simplify financial transactions for its customers. Our easy-to-use UPI payment system allows for seamless and secure transactions, ensuring that our clients can manage their finances with ease and convenience.

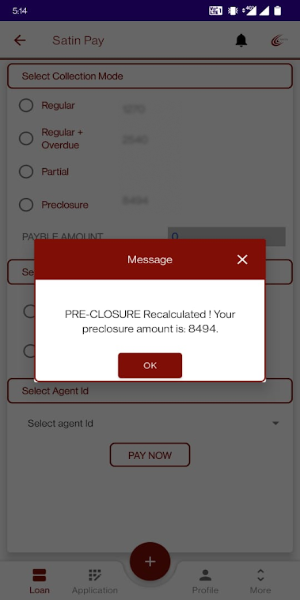

Loan Details and Management

Through our user-friendly platform, clients can access detailed information about their loans, including outstanding balances, repayment schedules, and transaction history. This transparency helps customers stay informed and manage their finances more effectively.

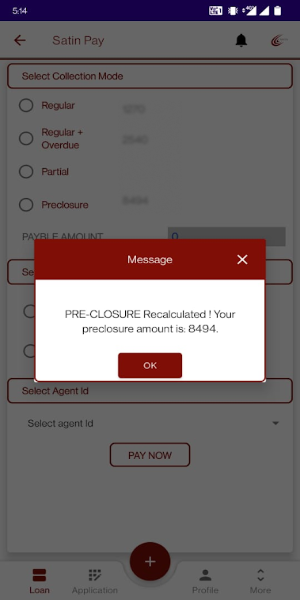

Loan Card and Weekly Collections

Our innovative loan card system provides a convenient way for clients to keep track of their loan activities and manage repayments. Additionally, our efficient weekly collection system ensures timely collection of loan repayments, enhancing the overall financial management process.

The JLG Model and Individual Lending

Joint Liability Group (JLG) Model

SCNL employs the Joint Liability Group (JLG) model, which involves lending to groups of individuals who collectively guarantee each other's loans. This model not only encourages group solidarity but also reduces the risk of loan default. It is particularly effective in reaching out to rural and semi-urban areas where traditional financial services are limited.

Individual-Based Lending

In addition to the JLG model, SCNL also provides individual-based microfinance services. These collateral-free, affordable micro-credit solutions are tailored to meet the needs of individuals who require financial support but lack access to mainstream banking services.

Nationwide Presence

With a dedicated workforce of approximately 13,000 employees and a growing network of over 1,300 branches across 22 states and Union Territories, SCNL has established a significant presence throughout India. Our extensive distribution network ensures that we can reach even the most remote and underserved areas, extending our financial services to a broader audience.

Commitment to Financial Inclusion

At SCNL, we believe that true growth goes beyond expanding our geographical presence. It also involves extending our services to financially excluded households, providing them with the tools and resources they need to improve their economic conditions and achieve financial independence.

Join the Financial Revolution with SCNL

Satin Creditcare Network Ltd. is more than just a financial institution; it is a catalyst for change and empowerment. With our diverse range of financial products, innovative technological solutions, and commitment to financial inclusion, SCNL is dedicated to transforming lives and fostering economic growth. Whether you are seeking to expand your business, secure a home, or access essential financial services, SCNL is here to support you every step of the way. Join us in our mission to create a more inclusive financial ecosystem and experience the difference that Satin Creditcare Network Ltd. can make in your life.

- No virus

- No advertising

- User protection

Information

- File size: 5.68 M

- Language: English

- Latest Version: v2.0.5

- Requirements: Android

- Votes: 100

- Package ID: com.satincreditcare.android.customerservice

- Developer: Satin Creditcare Network Ltd.

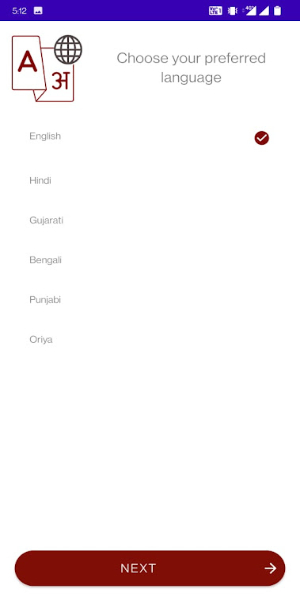

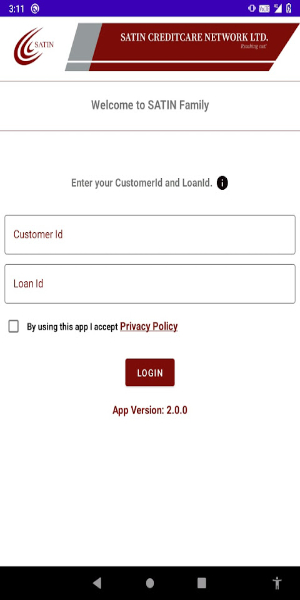

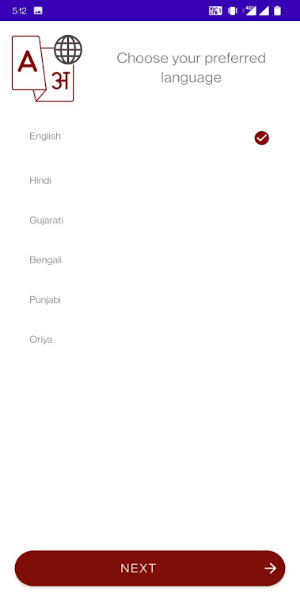

Screenshots

Explore More

Level up your phone with the most helpful tools for Ultimate productivity. From image editors and file managers to task trackers and weather widgets, these top-rated essentials make everyday tasks smooth and easy. Get organized, save time and optimize workflows with a powerful toolbox by downloading these editor's choice utilities today. Your phone will never be the same again!

Elra

Take and Go

UK Newspapers

NBC 5 Chicago

Etransport

Learn German Fast: Course

Football Logo Maker

Make A Wish Come True Genie

Comment