Introduction

Dhaka Credit is a comprehensive financial app designed for members of The Christian Co-operative Credit Union Ltd. Users can access their account details, manage loans, and perform ATM withdrawals using a Dynamic QR Code. It also offers real-time notifications about events and general information about credit union products and services.

Unlocking Financial Freedom with Dhaka Credit: Your Ultimate Guide

In the modern age of digital convenience, managing finances should be as simple as a few taps on your smartphone. Enter Dhaka Credit, an innovative app designed by The Christian Co-operative Credit Union Ltd. to offer its members seamless access to their financial information and services. This comprehensive guide explores the features, benefits, and unique offerings of the Dhaka Credit app, ensuring that every user can maximize its potential.

Welcome to Dhaka Credit: A New Era of Financial Management

Dhaka Credit is more than just an app; it's a gateway to efficient financial management for the members of The Christian Co-operative Credit Union Ltd. The app provides a suite of features designed to keep you informed, connected, and in control of your finances. Whether you're looking to stay updated on the latest events or manage your accounts with ease, Dhaka Credit has you covered.

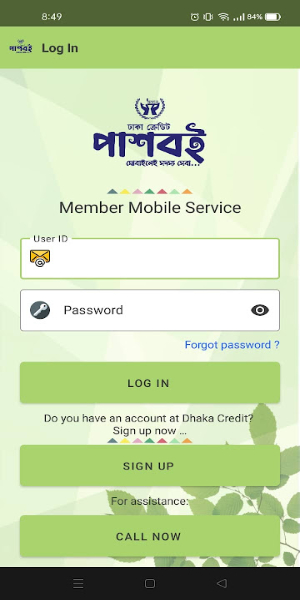

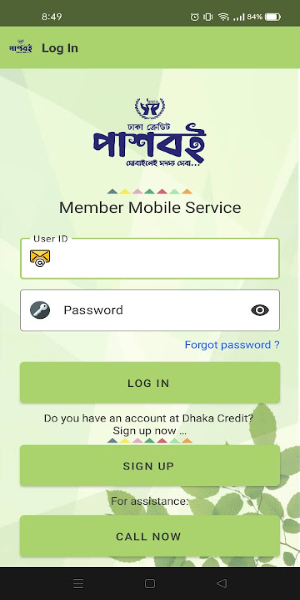

Seamless Registration: Your First Step Towards Convenience

Getting started with Dhaka Credit is a straightforward process. New users can register through the app, enabling them to access a plethora of services. However, to utilize the full range of features, including Mobile Financial Services (MFS), a visit to the nearest service center is required. This step ensures that all necessary verifications are completed, safeguarding your financial transactions.

Stay Informed: Real-Time Updates and Notifications

One of the standout features of Dhaka Credit is its ability to keep members informed about various events and updates. Through timely notifications, you will never miss out on important information, whether it's about new products, services, or exclusive offers. This feature is designed to enhance member engagement and ensure that you are always in the loop.

Comprehensive Account Management: All Your Details in One Place

With Dhaka Credit, managing your account has never been easier. After completing the registration process, members can access detailed information about their accounts directly from the app. This includes viewing account balances, transaction histories, and loan details. The app’s intuitive interface makes it simple to navigate and find the information you need.

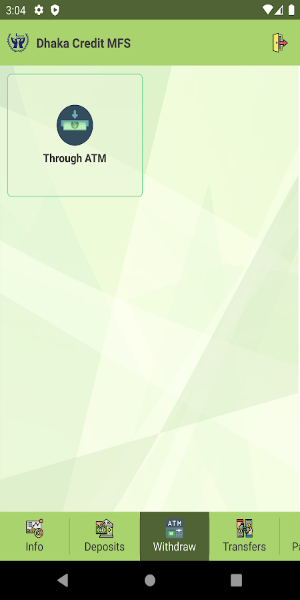

Dynamic QR Code: Revolutionizing Cash Withdrawals

One of the innovative features of Dhaka Credit is the ability to withdraw cash using a Dynamic QR Code. This feature allows members to perform ATM transactions without needing a physical card. Simply generate a QR code through the app, scan it at the ATM, and complete your transaction. This not only adds a layer of convenience but also enhances security by reducing the risk of card theft or loss.

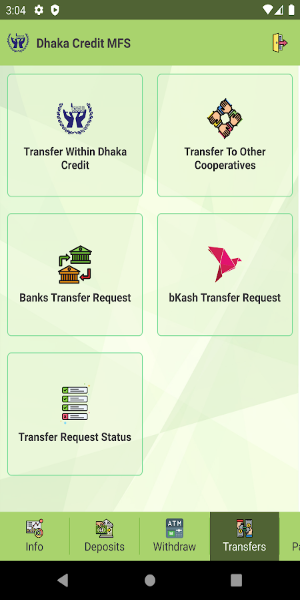

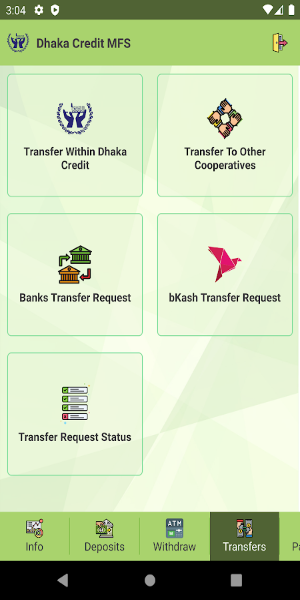

Mobile Financial Services (MFS): Banking at Your Fingertips

Dhaka Credit’s Mobile Financial Services offer a range of banking activities that can be conducted directly from your mobile device. Registered members can perform balance transfers, pay bills, and even apply for loans through the app. MFS is designed to bring the bank to your fingertips, making financial transactions faster and more convenient than ever before.

General Information Access: A Resource for All Users

Even if you’re not a registered member, Dhaka Credit still offers valuable resources. All users can access general information about the credit union’s products and services. This includes details about various loan options, savings accounts, and other financial products available to members. This transparency helps potential members understand the benefits of joining the credit union.

Enhanced Security Features: Protecting Your Financial Data

Security is a top priority for Dhaka Credit. The app incorporates advanced security measures to protect your financial information. From encrypted data transmissions to secure login protocols, every step is taken to ensure that your data remains safe and secure. The Dynamic QR Code feature further enhances security by minimizing the need for physical cards.

User-Friendly Interface: Designed for Ease of Use

The design of the Dhaka Credit app focuses on user experience. The interface is clean, intuitive, and easy to navigate, ensuring that even those who are not tech-savvy can use the app with ease. Clear menus and straightforward instructions guide users through various features, making financial management a breeze.

Customer Support: Assistance When You Need It

Dhaka Credit offers robust customer support to assist members with any issues or questions they may have. Whether you need help with the registration process, have a question about a transaction, or need technical assistance, the support team is readily available. This ensures that you have the help you need, when you need it.

Benefits of Dhaka Credit: Why You Should Join

-Choosing Dhaka Credit comes with a multitude of benefits:

-Convenience: Manage your finances anytime, anywhere.

-Security: Advanced security features protect your data.

-Comprehensive Services: Access a wide range of financial services from your mobile device.

-User-Friendly: An intuitive interface makes it easy to navigate the app.

-Community Engagement: Stay informed and connected with your credit union community.

Transforming Financial Management

Dhaka Credit is transforming the way members of The Christian Co-operative Credit Union Ltd. manage their finances. With its comprehensive features, user-friendly design, and robust security, it stands out as a must-have tool for anyone looking to streamline their financial management. Download Dhaka Credit today and take the first step towards financial freedom and convenience.

- No virus

- No advertising

- User protection

Information

- File size: 16.76 M

- Language: English

- Latest Version: v1.6.3

- Requirements: Android

- Votes: 100

- Package ID: com.dhakacredit.cccul

- Developer: Dhaka Credit

Screenshots

Explore More

Take charge of your finances anywhere with these top-rated money managers. Sleek budget planners help you curb splurges while investment trackers grow your wealth. Intuitive banking apps pay bills and transfer funds on the fly. Download now for an all-in-one personal finance solution. Stay on top of earnings, spending and more from your phone - be money-savvy wherever opportunity strikes!

Principles In Action

Paratic Haber: Ekonomi, Finans

Google Pay - a simple and secure payment app

Platform Residential

CA Mobile

Банки.ру

Money manager & expenses

Accounting Basics

Comment