Introduction

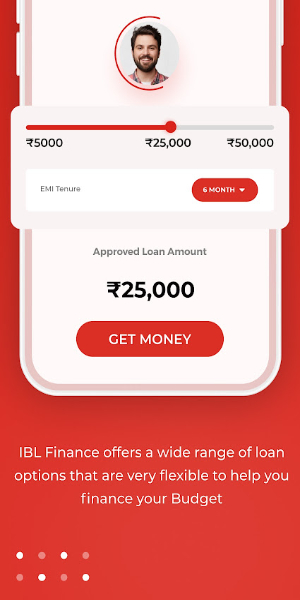

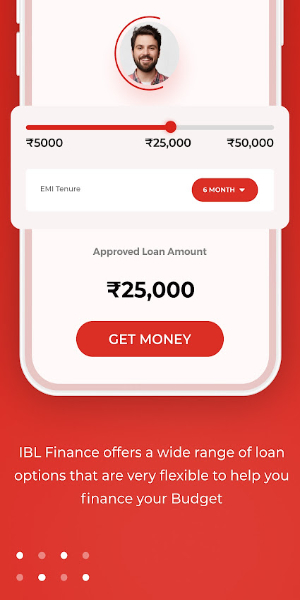

IBL simplifies money management with automated tracking of monthly expenses, ensuring you stay within budget and save effortlessly. Need quick cash or a personal loan? IBL offers instant, transparent loans up to ₹50,000, with easy eligibility checks and minimal paperwork. Apply directly through the app and receive funds straight into your bank account today.

Interest and Other Applicable Charges:

- Loan Amount: ₹ 2,000 to ₹ 50,000

- Minimum Annual Percentage Rate (APR): Starting from 15%

- Maximum Annual Percentage Rate (APR): Up to 36%

- Minimum Repayment Period: 3 months

- Maximum Repayment Period: 12 months

- Processing Fee on Personal Loan App: ₹ 0 to ₹ 1,500*

*Please note that these figures are for illustrative purposes only. Actual interest rates and processing fees may vary based on individual credit assessments.

Features of IBL – Instant Personal Loan and Automatic Money Manager App:

- Wide Range of Easy Instant Loans: IBL offers a diverse range of instant loan options tailored to meet various financial needs.

- Instant Loan Eligibility Check: Quickly assess your eligibility for loans without impacting your credit score, ensuring hassle-free access to credit.

- Quick Loan Application Process via Online Loan App: Apply for loans swiftly through the user-friendly IBL app, streamlining the application process.

- Convenience of Loan Repayment Through Various Payment Channels: Repay loans conveniently using multiple payment channels integrated into the app, ensuring flexibility.

- No Guarantors or Collaterals Needed: Enjoy the benefit of securing loans without the requirement of guarantors or collateral, simplifying the borrowing process.

- 100% Paperless Loan Application: Experience a seamless and environmentally friendly loan application process with no paperwork required.

- No Salary Slip or Income Proof Required: Obtain loans without the hassle of providing salary slips or income proofs, facilitating faster approvals.

- Instant Crediting of Loan to Your Bank Account: Once approved, loans are instantly credited to your bank account, ensuring immediate access to funds.

- Automatic Income Expense Tracking – Money Manager: Automatically track income and expenses within the app, helping you manage finances effectively.

- Auto Bank Account Balance Tracker: Monitor your bank account balances automatically through the IBL app, providing real-time financial visibility.

- Auto Credit Card Reporting: Easily track and manage credit card transactions automatically, enhancing financial management capabilities.

Precautions:

Loan Eligibility

- Indian Resident: Must be a citizen of India to qualify for loans with IBL.

- Above 21 Years of Age: Applicants must be at least 21 years old to be eligible for loans.

- Monthly Source of Income: A regular source of income is required to qualify for loans, ensuring repayment capability.

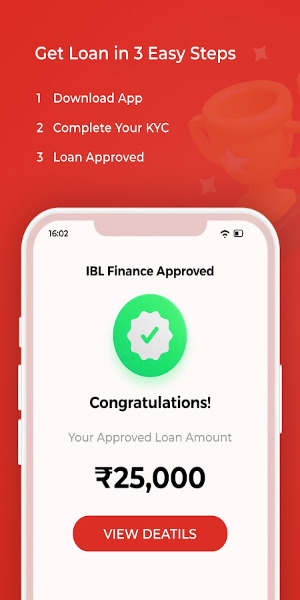

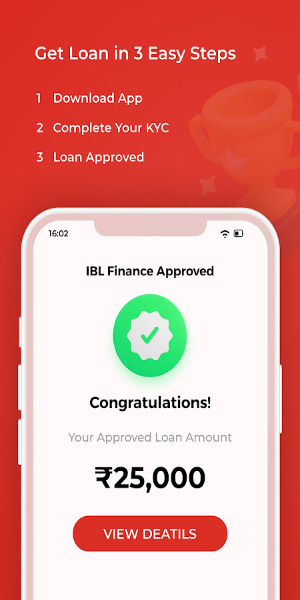

How to Apply for an Easy Loan with IBL

1. Install the IBL App: Download and install the IBL app from 40407.com.

2. Register through Mobile Number and OTP: Register on the app using your mobile number and verify with OTP for security.

3. Fill Your Basic Details to Know Your Instant Loan Eligibility: Provide basic information to check your eligibility for instant loans.

4. Submit KYC Documents and Apply for a Quick Loan: Upload necessary KYC documents such as selfie, PAN card, and Aadhaar card to complete the loan application process.

5. Once Application is Approved, We Transfer the Loan Directly to Your Bank Account: Upon approval, the loan amount is swiftly transferred to your registered bank account.

Documents Required to Apply for a Loan

- Selfie: A recent photograph of yourself.

- PAN Card: Permanent Account Number issued by the Income Tax Department.

- Aadhaar Card: Unique Identification card issued by the Government of India.

Benefits & Risks

1. Access to Higher Amounts & Tenures as You Repay on Time: Timely repayment increases your eligibility for higher loan amounts and longer repayment tenures.

2. Credit Score Impact: Your payment behavior is reported to credit rating agencies, influencing your credit score positively or negatively based on compliance with repayment terms.

Transform your financial journey with IBL, where applying for loans is straightforward and hassle-free. By meeting basic eligibility criteria and submitting essential documents, you can swiftly access loans tailored to your needs. Download the IBL app today to experience seamless loan processing and begin achieving your financial goals with confidence.

- No virus

- No advertising

- User protection

Information

- File size: 9.92 M

- Language: English

- Latest Version: v4.2

- Requirements: Android

- Votes: 100

- Package ID: com.ibl.moneymanagement.app

- Developer: IBL Finance Private Limited

Screenshots

Explore More

Entertain yourself endlessly on the go for zero cost! Packed with movies, shows, music and videos from around the world, these top-rated media apps will keep you engrossed for hours. Stream your favorite channels and playlists ad-free or download your favorites for offline viewing later. Download now to turn your phone into an unlimited personal theater - and enjoy premium entertainment that won’t drain your budget.

NBC 5 Chicago

Football Logo Maker

Card Maker For PKM

HandWriting Font Maker

Before and after: side by side

Rus.TVNET

MK AIMentor

Video Downloader & Video Saver

Comment