Introduction

Social Lender is an innovative lending app that uses social reputation to offer microcredit. Users can apply for loans quickly by leveraging their social media profiles, with funds typically disbursed within 10 minutes. The app provides an accessible solution for those with limited traditional credit options, streamlining the process of obtaining and managing loans.

Social Lender: Revolutionizing Microcredit with Social Reputation

Innovative Lending Solution Based on Social Media Profiles

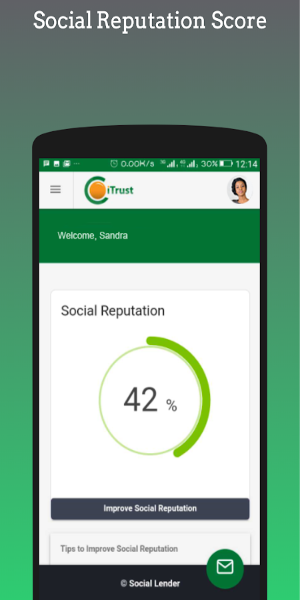

Social Lender is a groundbreaking lending solution that leverages social reputation to provide access to credit through mobile, online, and social media platforms. In regions where over 50% of adults lack access to formal credit, Social Lender bridges this gap by offering microcredit based on users' social profiles. By utilizing a proprietary algorithm to evaluate users’ digital footprints, Social Lender creates a Social Reputation Score that determines their eligibility for loans. This approach enables individuals with limited access to traditional financial services to secure quick cash through their social networks and online presence.

How Social Lender Works: A Three-Step Process

1. Access the Platform and Social Audit

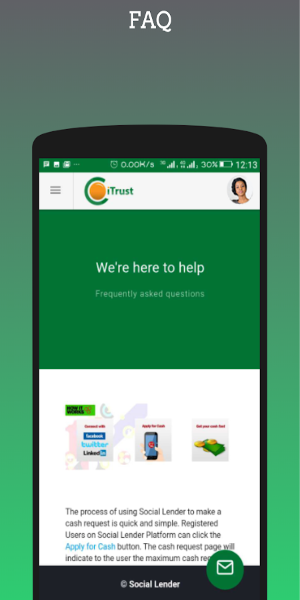

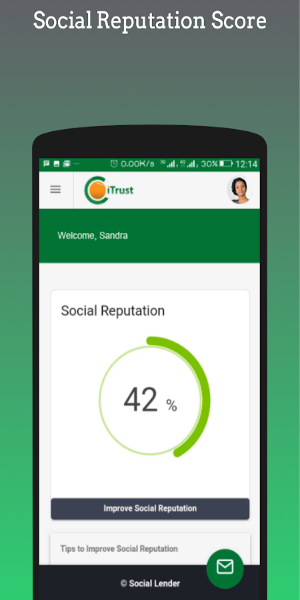

Users can access Social Lender’s services through various channels including the web, SMS, USSD, mobile apps (either partner app add-ons or dedicated apps), partner bank ATMs, APIs, or during e-commerce checkout via Pay with Social Lender. Upon accessing the platform, a social audit is conducted with the user’s consent. This audit reviews the user’s online behavior and social media activity to generate a Social Reputation Score. This score reflects the individual’s creditworthiness based on their social reputation.

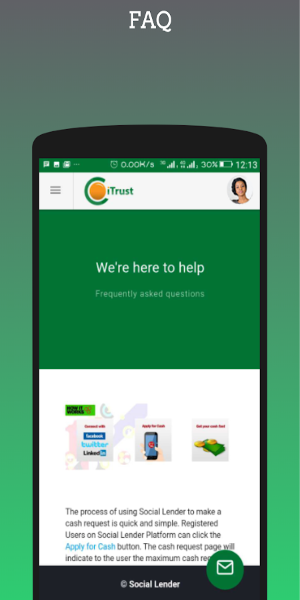

2. Apply for Cash

Once the social reputation score is determined, users can apply for a loan through any of the available channels. The application process is designed to be simple and fast, allowing users to request funds with minimal hassle. The flexibility of application channels ensures that users can access the service through their preferred method, whether on mobile, online, or at a partner bank’s ATM.

3. Receive Funds Quickly

After applying, the loan is processed according to the partner financial institution’s specific business rules. Social Lender guarantees that funds are typically disbursed to the user’s verified bank account or mobile money account within 10 minutes. This rapid turnaround ensures that users can access the cash they need promptly, making Social Lender a reliable solution for urgent financial needs.

Repayment Terms and Conditions

Social Lender operates under a license granted to financial institutions in the countries where it operates. The repayment period for loans can vary depending on the partner institution, with a minimum repayment term of one day and a maximum term of up to four years. This flexibility allows users to manage their repayments in a way that fits their financial situation.

Interest Rates and Transaction Charges

The interest rates and transaction charges for Social Lender loans depend on the partner financial institution. These can range from interest-free loans to those with a monthly interest rate of 5%, with a maximum annual percentage rate (APR) of 300%. Users are advised to review the specific terms provided by their lending partner. For instance, if a loan with a transaction charge rate of 15% is borrowed, and the user takes a loan of 3,000 Naira, they would repay a total of 3,450 Naira (3,000 Naira principal + 15% of 3,000 Naira).

Benefits of Using Social Lender

1. Accessibility for the Unbanked: Social Lender provides financial services to individuals who may not have access to traditional banking systems, addressing a significant gap in credit availability.

2. Fast and Efficient: With funds typically disbursed within 10 minutes, Social Lender offers a quick solution for immediate financial needs, making it a valuable resource for urgent cash requirements.

3. Flexible Application Channels: Users can apply for loans through various channels, including mobile apps, web platforms, and even partner ATMs, enhancing convenience and accessibility.

4. Social Reputation-Based Credit: By relying on social reputation rather than traditional credit histories, Social Lender offers a new way for individuals to access credit based on their online and social media activity.

Transforming Microcredit with Social Media Insights

Social Lender is redefining the landscape of microcredit by utilizing social media profiles and online behavior to assess creditworthiness. This innovative approach addresses the challenge of credit access for millions of individuals in regions with limited formal financial services. By offering a fast, secure, and flexible lending solution, Social Lender empowers users to meet their financial needs while leveraging their social reputation. With its rapid disbursement, diverse application channels, and adaptable repayment terms, Social Lender represents a significant advancement in making financial services more inclusive and accessible.

- No virus

- No advertising

- User protection

Information

- File size: 23.63 M

- Language: English

- Latest Version: v1.3.0

- Requirements: Android

- Votes: 100

- Package ID: com.sociallender.app

- Developer: Bincom ICT

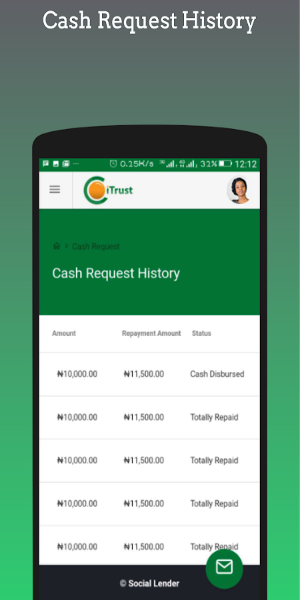

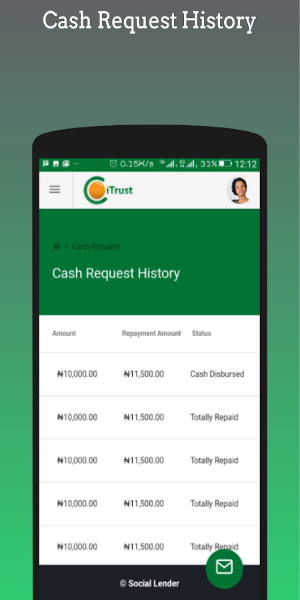

Screenshots

Explore More

Entertain yourself endlessly on the go for zero cost! Packed with movies, shows, music and videos from around the world, these top-rated media apps will keep you engrossed for hours. Stream your favorite channels and playlists ad-free or download your favorites for offline viewing later. Download now to turn your phone into an unlimited personal theater - and enjoy premium entertainment that won’t drain your budget.

サロン叶笑

English listening daily

Learn Spanish - 50 languages

Punjab Police-Women Safety App

Headify: AI Headshot Generator

Glance for realme

Audify Notification Announcer

Vault-Hide Pics & Videos,App Lock, Free backup

Comment