Introduction

Welcome to Fintech Loans. App that loans you money, cash 2 u loans, rupee loans, instant loans via mpesa, loans during lockdown, loans for bad credit, loans for self employed. We provide loans through mobile phones. The loans are processed and disbursed within 30 minutes direct to your phone.

Unlock Your Financial Potential with Fintech Loans

In an ever-evolving financial landscape, accessing funds to propel your dreams forward should be seamless, efficient, and tailored to your individual needs. At Fintech Loans, we harness the power of innovative technology to connect borrowers with the financial solutions they need, all while providing an unparalleled user experience.

How to proceed:

* Download and install the Fintech Loans App on your smartphone

* Launch the App and register by providing your personal details

* View your loan limit and submit your loan request

Why Choose Fintech Loans?

Benefits

-No registration fees, you just sign up and proceed to request a loan.

-We don't require any paperwork or security/guarantors

-You can request a loan from any physical location without having to travel

-Loan applications are processed within 30 minutes

-You receive the exact loan amount you apply forWhat we offer:

1. Loan repayment period of between 90 days and 365 days.

2. Loan amounts starting from 250 to 50,000.

3. Interest rate of 8% & a maximum APR of 25%.

4. Top ups with just few clicks.

5. Due date extensions.

6. Limit increase with early or timely repayments.

For example a loan of 500, with interest rate of 8%, the loan amount will be repaid in full in 90 days.

The customer will be required to pay 540 only. No additional charges.

Tailored Solutions to Fit Your Needs:

Whether you’re looking to expand your business, finance a major purchase, or consolidate debt, our range of loan products is designed to meet your specific financial requirements. With customizable terms, competitive interest rates, and a simple application process, we ensure that you can find a solution that perfectly aligns with your goals.

Speed and Convenience:

In today’s fast-paced world, time is money. Our streamlined, tech-driven application process allows you to apply for a loan in minutes without overwhelming paperwork. Utilizing advanced algorithms, we provide instant approvals and rapid funding to ensure you can seize opportunities without unnecessary delays.

Transparent and Fair Practices:

At Fintech Loans, we believe in transparency. Our clear fee structures and straightforward terms mean that there are no hidden surprises down the line. We prioritize building trust with our clients, so you can make informed financial decisions based on complete visibility into your loan details.

Cutting-Edge Technology:

Harnessing artificial intelligence and machine learning, our platform analyzes your financial history and creditworthiness in real time, offering personalized loan options that reflect your current situation and future potential. This not only enhances your borrowing experience but also enables us to provide better rates and terms.

Dedicated Support:

Our commitment to our clients goes beyond the loan. We provide personalized support from our team of financial experts who are ready to assist you throughout your journey. Whether you have questions about loan terms or need advice on financial planning, we’re here to help you every step of the way.

How It Works: A Simple 3-Step Process

1. Apply:

Begin by completing our straightforward online application form. Our user-friendly interface guides you through the essential steps, making the process hassle-free.

2. Review:

Once submitted, our advanced system evaluates your application quickly. You’ll receive an instant decision, with transparent information on loan amounts, interest rates, and terms tailored to you.

3. Fund:

Once you accept your loan offer, funds can be deposited into your account within 24 hours—allowing you to take action without prolonged wait times.

Who Can Benefit from Fintech Loans?

- Small Business Owners:

Access the capital you need to grow, hire new employees, or invest in crucial equipment.

- Individuals Seeking Consolidation:

Combine multiple debts into one manageable loan, potentially lowering your interest payments.

- Households in Need of Extra Cash:

Whether for a home renovation, education expenses, or unforeseen medical bills, we provide the financial support you need.

Privacy & Permissions

We take privacy very seriously and your personal information will never be shared without your direct permission.

Experience the Future of Financing

In an age where convenience and efficiency are paramount, Fintech Loans is leading the charge to redefine the borrowing experience. With a focus on innovation, customer-centric solutions, and a commitment to financial empowerment, we’re here to help you unlock your financial potential.

Don’t let opportunities pass you by due to financial constraints. Join the thousands who have found their solution with Fintech Loans. Visit our website today to learn more and start your application.

⭐ Your future awaits! ⭐

- No virus

- No advertising

- User protection

Information

- File size: 8.00 M

- Language: English

- Latest Version: v1.1034

- Requirements: Android

- Votes: 100

- Package ID: q.loan.credit.fintech.loans

- Developer: izwa Loans

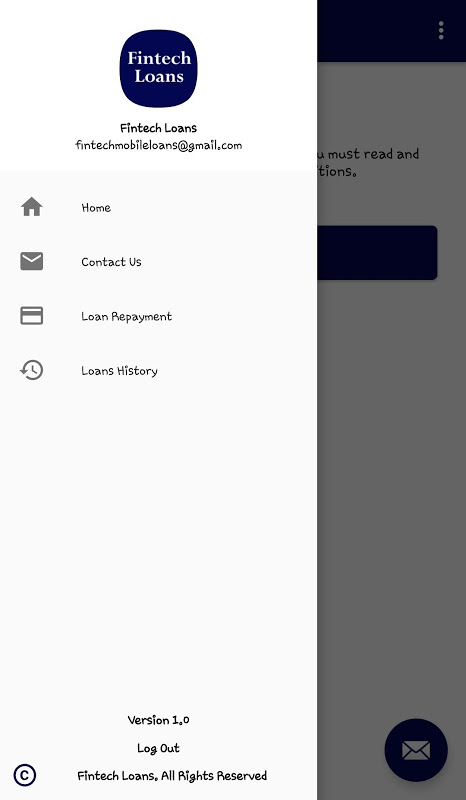

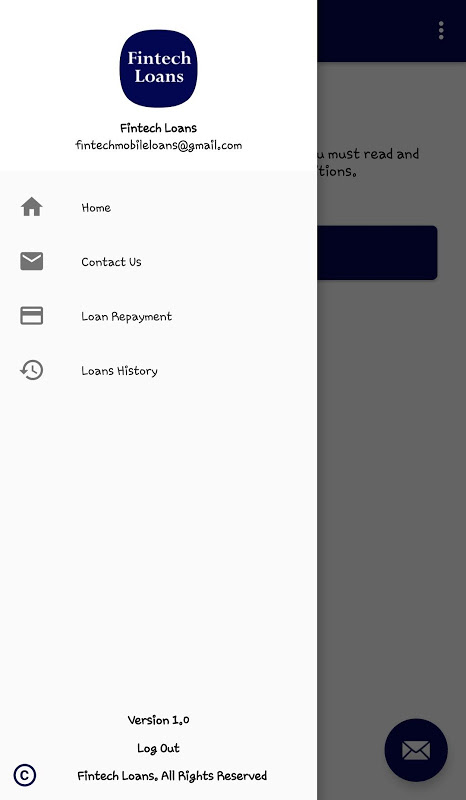

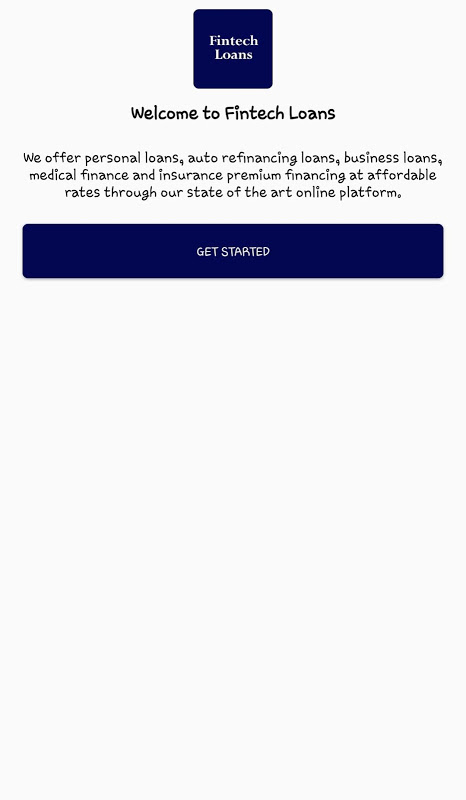

Screenshots

Explore More

Explore the world without leaving your phone! These top-rated travel apps make planning adventures easy and affordable. Find flights and hotels, get maps and guides for cities, learn useful phrases or read insights from locals. Now enjoy armchair sightseeing or turn upcoming trips into reality. Download your passport to global discovery - with premium features free, your next expedition starts here!

Etransport

Learn German Fast: Course

Horaires Me ! (Paris)

Marcel | VTC | Chauffeur Privé

Compare rideshares & taxis

기차여행

TalkMate

Screen and Photo Translator

Comment