Introduction

Embark on a streamlined and informative exploration of home loans with Home loan calculator -Tool. Navigate the intricacies of home financing with ease, benefiting from a user-friendly interface and an array of features designed to simplify your financial planning journey on the Credit Dharma platform.

Standout Aspects of Home loan calculator -Tool:

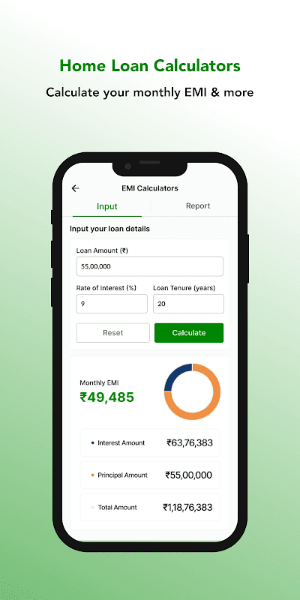

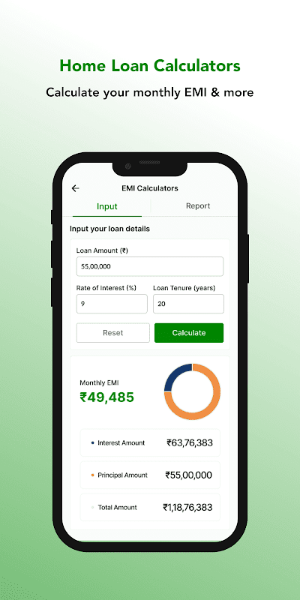

EMI Calculation Made Simple

Easily compute your monthly EMI payments by entering your loan amount, interest rate, and tenure. Receive a detailed breakdown instantly to plan your finances effectively.

Transparent Interest Breakdown

Gain clarity on the total interest payable throughout your loan term. Understand the financial implications to make informed decisions about your borrowing.

Detailed Amortisation Schedule

Access a year-wise or month-wise breakdown of principal and interest payments. This feature provides a clear trajectory of your loan repayment journey, aiding in financial planning.

Balance Transfer Advisor

Evaluate the feasibility of transferring your loan to another bank. Compare interest rates and terms to determine potential savings and benefits.

Efficient Prepayment Planning

Strategize loan prepayments to reduce total interest outlay and shorten the loan tenure. Visualize the impact of partial prepayments on your loan using our intuitive planner.

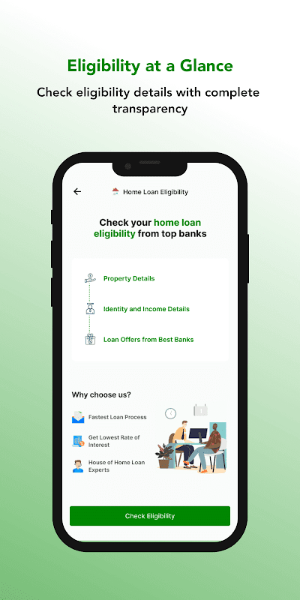

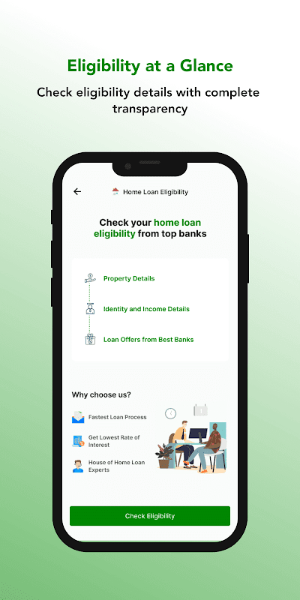

Customized Eligibility Calculator

Input your financial details to gauge your borrowing capacity comfortably. Receive tailored recommendations on loan amounts that suit your financial profile.

Document Checklist Assistance

Access a comprehensive list of documents required for home loan applications, tailored to different employment types. Ensure smooth processing with our detailed checklist.

Real-Time Updates

Stay informed with instant notifications on changes in interest rates, policy updates, and personalized financial tips. Keep abreast of market trends and optimize your loan strategy accordingly.

Expert Financial Advice

Seek guidance from a panel of financial experts for personalized insights into your home loan queries. Benefit from expert advice to make informed financial decisions.

Overview of Home Loan EMI Calculator:

Understanding the Home Loan EMI Calculator

A home loan EMI calculator serves as a financial tool designed to assist individuals in estimating their monthly repayments for a home loan. It provides a clear picture of the monthly EMI based on factors such as loan amount, interest rate, and loan tenure, facilitating informed financial planning.

Advantages of Using a Home Loan EMI Calculator

- Precise Repayment Estimates: Eliminates manual calculations and offers accurate estimates of monthly instalments. By entering details like loan amount, interest rate, and tenure, users can instantly view their expected EMI amount.

How to Utilize a Home Loan EMI Calculator

Using a home loan EMI calculator is straightforward and user-friendly. Here’s how to make the most of it:

- Enter Loan Details: Input the loan amount, interest rate, and tenure into the designated fields of the EMI calculator.

- Analyze and Plan: Utilize the calculated EMI amount to assess your financial readiness. Consider your monthly income, existing expenses, and savings to determine affordability. Adjust inputs as necessary to explore alternative repayment scenarios.

Explore the efficiency of the Home Loan EMI Calculator for accurate financial planning. Simplify your loan repayment calculations and make informed decisions about your home loan journey. Download now to empower your financial decisions with precision and confidence.

- No virus

- No advertising

- User protection

Information

- File size: 25.61 M

- Language: English

- Latest Version: v2.0.3

- Requirements: Android

- Votes: 100

- Package ID: com.tresscommas.threedots

- Developer: threedots

Screenshots

Explore More

Take charge of your finances anywhere with these top-rated money managers. Sleek budget planners help you curb splurges while investment trackers grow your wealth. Intuitive banking apps pay bills and transfer funds on the fly. Download now for an all-in-one personal finance solution. Stay on top of earnings, spending and more from your phone - be money-savvy wherever opportunity strikes!

Paratic Haber: Ekonomi, Finans

Google Pay - a simple and secure payment app

Platform Residential

CA Mobile

Money manager & expenses

Accounting Basics

Bills Organizer -RemindonTime

Idram & IDBank

Comment