Introduction

Are you ready to turn your homeownership dreams into reality? Whether you're a first-time buyer or looking to upgrade, finding the right mortgage loan shouldn’t be a daunting task. Let us guide you through the maze of home financing with enthusiasm, expertise, and a smile!

Comprehensive Home Loan Information: Your Guide to Mortgage Loans

Navigating the world of mortgage loans can be overwhelming, but with the right information, you can make informed decisions that lead to your dream home. Here’s everything you need to know:

Understanding Mortgage Basics

A mortgage loan is a type of loan specifically used to finance the purchase of real estate. It typically involves borrowing a large sum of money from a lender (such as a bank or credit union) and repaying it over a set period with interest.

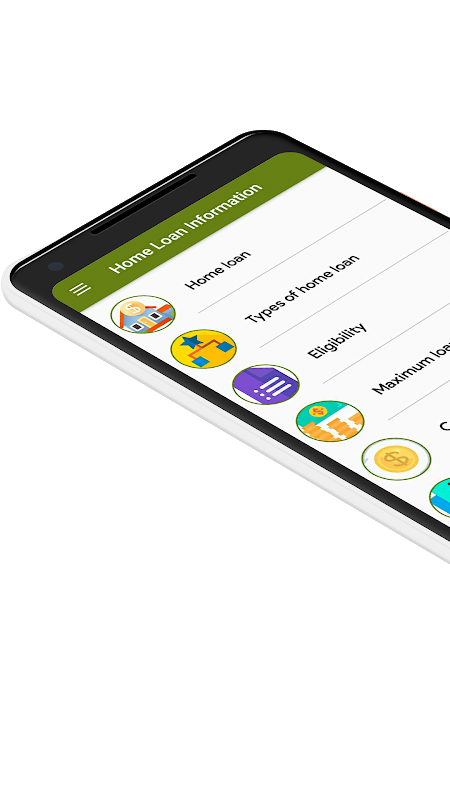

Types of Mortgage Loans

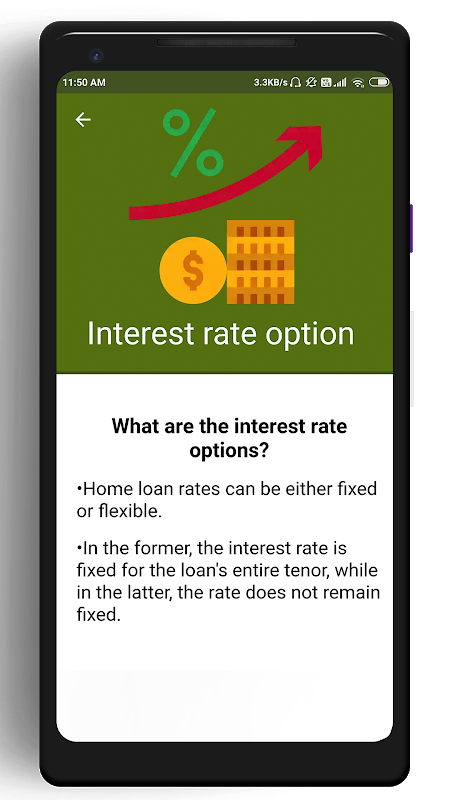

1. Fixed-Rate Mortgage: Offers a stable interest rate throughout the loan term, ensuring predictable monthly payments.

2. Adjustable-Rate Mortgage (ARM): Initially offers a lower interest rate that adjusts periodically based on market conditions, potentially affecting monthly payments.

3. FHA Loans: Insured by the Federal Housing Administration, these loans are designed to help low-to-moderate-income borrowers with lower down payment requirements.

4. VA Loans: Guaranteed by the Department of Veterans Affairs, these loans are available to eligible veterans, active-duty service members, and certain spouses, offering favorable terms and no down payment options.

Steps to Getting a Mortgage Loan

1. Preparation: Assess your financial situation, review your credit score, and gather necessary financial documents (income statements, tax returns, etc.).

2. Pre-approval: Get pre-approved for a mortgage to determine your borrowing capacity and strengthen your offer when buying a home.

3. Choosing a Loan: Select a mortgage type that aligns with your financial goals and preferences, considering factors like interest rates, loan terms, and down payment requirements.

4. Application Process: Complete the mortgage application, provide required documentation, and await approval from the lender.

5. Closing: Finalize the loan agreement, sign the necessary documents, and complete the transaction to officially become a homeowner.

Why Choose Us?

⭐ Expert Guidance: Our team of seasoned mortgage specialists is dedicated to making the process as smooth as possible. From understanding your options to securing the best rates, we’re here to lend an ear and share our expertise every step of the way.

⭐ Tailored Solutions: Everyone’s financial situation is unique! That’s why we offer a range of home loan products designed to fit your specific needs. Whether you’re eyeing a fixed-rate mortgage for stability or an adjustable-rate option for flexibility, we’ve got you!

⭐ Competitive Rates: We believe in giving you the best deal possible. Not only do we pride ourselves on offering competitive interest rates, but we’ll also walk you through the potential costs so you can plan your budget with confidence!

⭐ Fast and Flexible Approval Process: Your time is valuable! With our streamlined application process, you won’t be left waiting in uncertainty. We work tirelessly to ensure you get the answers you need — fast!

⭐ Educational Resources: Knowledge is power! We provide a wealth of information about home loans, interest rates, repayment options, and more. Our website is filled with guides, FAQs, and tools to help you understand the ins and outs of mortgage loans, empowering you to make informed decisions.

Factors Impacting Mortgage Loans

- Credit Score: A higher credit score typically leads to better interest rates and loan terms.

- Down Payment: The amount you contribute upfront affects your loan amount, monthly payments, and potentially, the need for private mortgage insurance (PMI).

- Interest Rates: Market conditions and loan type influence the interest rate you receive, impacting your overall loan costs.

Choosing the Right Mortgage Lender

Research lenders, compare offers, and consider factors beyond interest rates, such as customer service, loan processing times, and reputation within the community.

Expert Advice and Support

Consult with mortgage professionals to understand your options, evaluate affordability, and ensure a smooth borrowing experience from application to closing.

Begin Your Home Loan Journey Today!

Armed with this information, you're ready to embark on your home buying journey confidently.

Whether you're a first-time homebuyer or refinancing, finding the right mortgage loan is key to achieving your homeownership goals.

- No virus

- No advertising

- User protection

Information

- File size: 3.90 M

- Language: English

- Latest Version: v1.6

- Requirements: Android

- Votes: 100

- Package ID: com.homeloan.information.mortgageloan

- Developer: 4K Production

Screenshots

Explore More

Level up your phone with the most helpful tools for Ultimate productivity. From image editors and file managers to task trackers and weather widgets, these top-rated essentials make everyday tasks smooth and easy. Get organized, save time and optimize workflows with a powerful toolbox by downloading these editor's choice utilities today. Your phone will never be the same again!

А2 Сервис

OCR Instantly

新北校園通

قرآن | ورش التجويد

Mockitup

Headify: AI Headshot Generator

Body Editor - AI Photo Editor

Utah Hunting and Fishing

Comment