Introduction

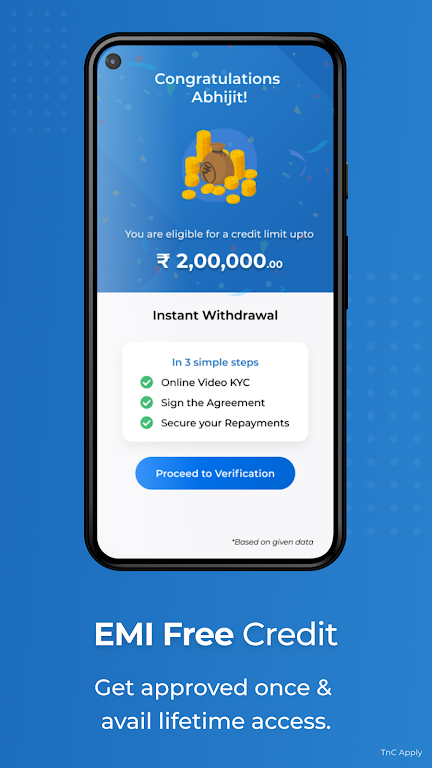

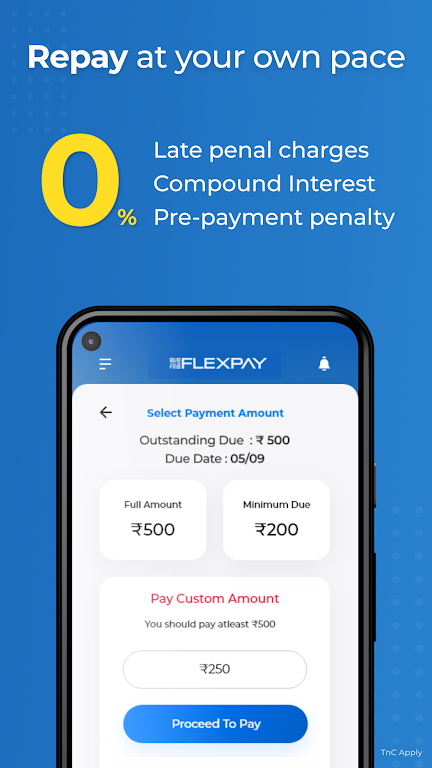

Introducing FlexPay: Personal Loan App app, the ultimate personal loan app that is revolutionizing the way you access credit. With the app, you can now get a loan of up to 3 lakhs instantly, all from the comfort of your own home. Our loan offerings come from Vivifi India Finance Pvt. Ltd., a trusted non-banking financial company registered with the RBI. Plus, with APR ranging from 19% to 55%, we offer flexible monthly installments that suit your budget. And the best part? No late fees, bounce check fees, or prepayment penalties. So why wait? Experience the power of convenience with the app, the fastest and most user-friendly personal loan app in India.

Features of FlexPay: Personal Loan App:

⭐ Instant Access to Credit: The app allows users to access instant credit, providing them with the financial support they need in a quick and efficient manner. Whether it's for groceries, medicines, or other essentials, users can get the funds they need right away.

⭐ Simple and Quick Loan Application Process: The app ensures a seamless and hassle-free loan application process. Users can complete the application within minutes, without the need for extensive paperwork or long waiting times. This makes it convenient for individuals who require immediate financial assistance.

⭐ Scan-Now Pay-Later Option: The app offers a unique feature that allows users to scan their purchase receipts and defer payment for later. This option gives users the flexibility to manage their finances and pay for their expenses at a more convenient time.

FAQs:

⭐ How can I apply for a loan through the app?

To apply for a loan on the app, simply download the app and complete the online application process. You will need to provide some basic personal and financial information. Once your application is approved, the funds will be disbursed to your bank account on the same day.

⭐ What is the interest rate for the loans offered by the app?

The annual interest rate for FlexPay loans ranges from 19% to 55%. The actual rate you receive will depend on various factors, including your creditworthiness and the loan amount. It is important to review the terms and conditions before agreeing to the loan.

⭐ Can I repay the loan before the tenure ends?

Yes, the app allows for prepayment of the loan without any penalty. You can choose to repay the loan earlier if you wish, saving on interest charges.

Conclusion:

FlexPay: Personal Loan App is an innovative personal loan app that provides users with instant access to credit, ensuring their financial needs are met swiftly. With its simple and quick loan application process, users can apply for a loan within minutes, without any hassle. The app also offers a unique Scan-Now Pay-Later option, granting users the flexibility to manage their expenses more efficiently. Whether it's for groceries, medicines, or other essential purchases, the app is designed to simplify the lives of its users and provide them with a convenient financing solution.

- No virus

- No advertising

- User protection

Information

- File size: 34.50 M

- Language: English

- Latest Version: 4.9

- Requirements: Android

- Votes: 280

- Package ID: in.india.upi.flexpay

- Developer: VIVIFI - Instant Personal Loan & Online Loan App

Screenshots

Explore More

Entertain yourself endlessly on the go for zero cost! Packed with movies, shows, music and videos from around the world, these top-rated media apps will keep you engrossed for hours. Stream your favorite channels and playlists ad-free or download your favorites for offline viewing later. Download now to turn your phone into an unlimited personal theater - and enjoy premium entertainment that won’t drain your budget.

Headify: AI Headshot Generator

Glance for realme

Audify Notification Announcer

Vault-Hide Pics & Videos,App Lock, Free backup

AI Music&Song Maker

Nyah-gruppen

Puneet Superstar Stickers

WFSB

Comment