Introduction

The PM SVANidhi – Official Mobile Application is a comprehensive solution designed to streamline the loan application process for lending institutions such as banks, NBFCs, and MFIs. Developed by MoHUA, this app aims to support the "PM Street Vendor’s AtmaNirbhar Nidhi" initiative by providing collateral-free working capital loans of up to ₹10,000 to approximately 50 lakh street vendors. To encourage good repayment behavior and digital transactions, the scheme offers incentives like a 7% per annum interest subsidy and cash-back rewards of up to ₹100 per month. With the inclusion of NBFCs and MFIs as lending institutions, the scheme's impact is expected to be maximized. This scheme will be active until March 2022. For more information, please visit the official scheme website.

Features of PM SVANidhi:

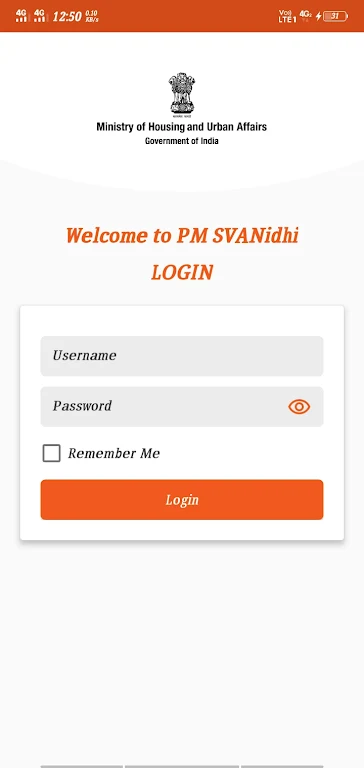

❤ Simplified Loan Application Process: The app offers a user-friendly interface that simplifies the loan application process for street vendors. It allows field agents of lending institutions such as banks, NBFCs, and MFIs to initiate and process loan applications on behalf of beneficiaries.

❤ Collateral-Free Working Capital Loan: Street vendors who have been adversely affected by the COVID-19 pandemic can avail a collateral-free working capital loan of up to ₹10,000. This loan comes with a tenure of 1 year, providing the necessary financial support to resume their businesses and recover from the economic impact.

❤ Incentives for Good Repayment Behavior: To encourage timely repayment and promote digital transactions, the PM SVANidhi scheme offers attractive incentives. Beneficiaries are eligible for an interest subsidy of 7% per annum, reducing the burden of loan repayment. Additionally, they can receive cash-back incentives of up to ₹100 per month, further motivating them to maintain good repayment behavior.

❤ Inclusion of NBFCs and MFIs: For the first time, non-banking financial companies (NBFCs) and microfinance institutions (MFIs) have been included as lending institutions under the PM SVANidhi scheme. This inclusion aims to maximize the scheme's reach and ensure that street vendors from various backgrounds and locations can access the financial support they need.

FAQs:

❤ Who is eligible to apply for the PM SVANidhi scheme?

Any street vendor who has been in the street vending business prior to or on March 2022 and has been adversely affected by the COVID-19 pandemic is eligible to apply for the scheme.

❤ How can I apply for a loan through the app?

To apply for a loan, you need to approach the field agents of the lending institutions, who will assist you in completing the loan application process through the app.

❤ What documents are required to apply for the loan?

The required documents include Aadhaar card, bank account details, a photograph of the street vendor, and relevant business documents such as vending certificate, identity proof, etc.

Conclusion:

The PM SVANidhi - Official Mobile Application is a one-stop solution for lending institutions to process loan applications of street vendors. With its simplified application process, collateral-free working capital loan, incentives for good repayment behavior, and inclusion of NBFCs and MFIs, the app aims to provide much-needed financial support to street vendors affected by the pandemic. By leveraging this app, street vendors can conveniently access the financial assistance they need to revive their businesses and rebuild their livelihoods. Don't miss out on this opportunity to avail the benefits of the PM SVANidhi scheme and download the app now.

- No virus

- No advertising

- User protection

Information

- File size: 21.10 M

- Language: English

- Latest Version: 1.0.10

- Requirements: Android

- Votes: 235

- Package ID: com.mohua.pmsvanidhi

- Developer: Ministry of Housing and Urban Affairs

Screenshots

Explore More

Take charge of your finances anywhere with these top-rated money managers. Sleek budget planners help you curb splurges while investment trackers grow your wealth. Intuitive banking apps pay bills and transfer funds on the fly. Download now for an all-in-one personal finance solution. Stay on top of earnings, spending and more from your phone - be money-savvy wherever opportunity strikes!

غريسه للشحن الفوري والباقات

Principles In Action

Paratic Haber: Ekonomi, Finans

Google Pay - a simple and secure payment app

Platform Residential

카카오페이

CA Mobile

Банки.ру

Comment