Introduction

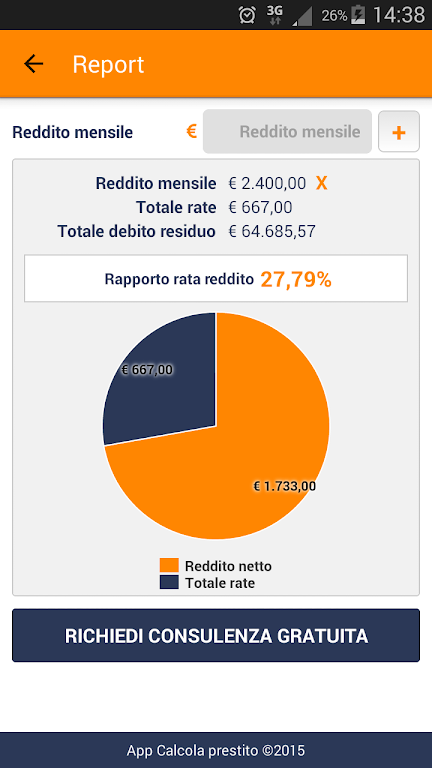

Introducing the groundbreaking Calcola Prestito app, the first of its kind in Italy! This incredible tool revolutionizes the way we monitor and manage loans. With an easy-to-use interface, the "MY LOANS" section allows users to enter details of their current loans, including mortgage, personal loan, salary assignment, and payment delegation. From there, you can effortlessly track the residual debt, interest, number of installments paid and remaining, and even develop an amortization plan. Worried about forgetting payment dates? No more stress – simply set installment reminders to keep you on track. And rest assured, all your information is securely stored on your device, guaranteeing privacy. The "CALCULATOR" section offers simulations for various loan scenarios, giving you valuable insights into your residual debt, installment amounts, net revenue, APR, TAN, and more.

Features of Calcola Prestito:

Easy Loan Monitoring: The app is the first app in Italy that allows users to monitor the course of their loans. With its intuitive interface, users can easily enter the details of their current loans and track important information such as the residual debt, interest, number of paid and remaining installments, and even develop an amortization plan.

French-Style Amortization: Unlike other loan monitoring apps, the app offers a unique feature of a French-style amortization plan. This type of plan is commonly used in France and provides a fixed rate for loans like mortgages, personal loans, salary assignments, and payment delegations. Users can input their loan references and calculate their amortization plan to better understand their loan repayment schedule.

Early Repayment and Renegotiation: Calcola Prestito not only helps users track their loans but also empowers them to make informed financial decisions. With the app, users can evaluate the feasibility of an early loan repayment or consider renegotiating their loan terms. This feature can potentially save users money by reducing interest payments or shortening the loan duration.

Set Reminders: To ensure timely loan repayments, the app allows users to set installment reminders. Users can choose the specific day and time they want to be reminded, ensuring that they never miss a payment and avoid late fees or penalties.

FAQs:

Are my loan details safe? Yes, Calcola Prestito ensures the safety and privacy of user data. The information entered into the app is saved exclusively on the user's device and cannot be accessed by third parties.

Can I simulate different loan scenarios? Absolutely! In the "Calculator" section of the app, users can perform simulations for various loan scenarios. This includes calculating the residual debt, installment amounts, net revenue, APR, and TAN for different possibilities. The app provides a comprehensive analysis for users to better understand their financial options.

Are the interest rates up to date? Yes, the app provides updated EURIBOR EURIRS, and ECB rates. This ensures that users have the latest information and conditions when making loan calculations or requesting a free quote.

Conclusion:

Calcola Prestito is a game-changer in loan monitoring and financial planning in Italy. With its user-friendly interface, unique features like the French-style amortization plan, and the ability to simulate different loan scenarios, users can easily stay on top of their loan repayments and make informed decisions about their loans. The added convenience of setting reminders and the assurance of data privacy make the app a must-have app for anyone managing loans. Download the app now and take control of your loans and financial future.- No virus

- No advertising

- User protection

Information

- File size: 15.20 M

- Language: English

- Latest Version: 3.3.1

- Requirements: Android

- Votes: 121

- Package ID: it.zerounodue.calcolaprestito

- Developer: Adriano Testani

Screenshots

Explore More

If you urgently need money, then look no further. Explore our curated compilation of personal loan software designed to streamline the borrowing process in 2024. These applications offer a range of tools, including loan management, borrower assessment, and financial tracking, providing comprehensive solutions for borrowers and lenders alike.

PhonePe UPI, Payment, Recharge

Fullerton Saathi

HS Finance

Fortiva Account Center

RefOEarn - Refer and Earn App, Earn Money Online

Updraft

TunaiKita – Pinjaman Uang Tunai Online Dana Cepat

Thanachart Connect

Comment