Introduction

LendMN is a financial service app that allows users to obtain quick, collateral-free loans using an AI-based credit scoring system. Users can also make online payments and transactions with ease. LendMN prioritizes user privacy, offers flexible repayment options, and features no transaction fees.

LendMN: Revolutionizing Financial Services in Mongolia

In a rapidly evolving financial landscape, LendMN stands out as a pioneering force. As the first FinTech financial service company in Mongolia, LendMN empowers its customers by providing quick, collateral-free loans through a sophisticated mobile application powered by Artificial Intelligence (AI)-based credit scoring. Let’s delve into the features and services that make LendMN an indispensable tool for financial management.

Seamless Online Financial Services

LendMN offers a suite of online financial services designed to meet the diverse needs of its customers. Operating under the strict laws and regulations of Mongolia, LendMN ensures a secure and reliable platform for:

Online Loans: Obtain instant loans without the need for collateral.

Online Payments and Transactions: Conduct seamless financial transactions with ease.

Commitment to Privacy

At LendMN, we prioritize the privacy and security of our customers’ personal information. Our privacy policy is designed to safeguard your data, ensuring that it is never disclosed unless required by legal authorities under applicable laws. You can trust LendMN to handle your information with the utmost care and confidentiality.

Easy Registration Process

Getting started with LendMN is a breeze. Follow these simple steps to register and become a valued customer:

Download the LendMN Application: Available on major app stores.

Register and Sign the Contract: Follow the on-screen instructions to register. Once you sign the one-time contract, you become an official LendMN customer.

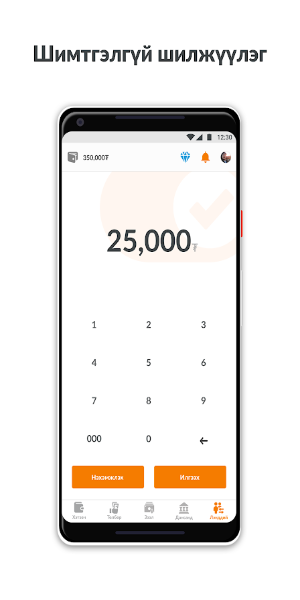

No Transaction Fees

One of the standout features of LendMN is the absence of transaction fees between digital wallets and bank accounts. This ensures that you can manage your finances without worrying about additional costs.

Flexible Credit Line

LendMN offers a dynamic credit line powered by AI-based credit scoring. This system allows consumers to determine their credit line eligibility and meet their financial needs with flexible loan conditions. Key details include:

Loan Amount: MNT 50,000 – MNT 2,000,000

Monthly Interest Rate: 3%

Annual Percentage Rate (APR): 36%

Minimum Payment Rate: 10% of the disbursed loan amount

Credit Line Period: Minimum repayment period is 5 months, while the maximum repayment period is 40 months.

Eco Car Loan

For those looking to invest in eco-friendly vehicles, LendMN offers specialized Eco Car Loans with competitive rates and terms:

Loan Amount: Up to MNT 20,000,000

Monthly Interest Rate: 2.3%-2.6%

APR: 27.6% to 31.2%

Repayment Period: 36 to 48 months

Loan Disbursement Service Commission: 0.5% of the disbursed loan amount

Representative Examples

Credit Line Example:

Loan Amount: 100,000 MNT

Loan Term: 3 months

Monthly Interest Rate: 3% + 500 MNT (bank transaction fee)

Monthly Repayment: 35,833 MNT

Total Interest: 7,560 MNT

Total Amount Payable: 107,560 MNT

Eco Car Loan Example:

Loan Amount: 20,000,000 MNT

Loan Term: 48 months

Monthly Interest Rate: 2.3%

Monthly Repayment: 692,607 MNT

Total Payment Amount: 33,245,157 MNT

Convenient Repayment Options

LendMN ensures that repaying your loan is as convenient as borrowing it. Customers receive scheduled loan repayment reminders via SMS and push notifications. Loans can be repaid directly through the LendMN app or via local bank mobile applications. Additionally, you can repay and reloan instantly without the need for re-application, providing a seamless financial experience.

Empowering Financial Freedom

LendMN is more than just a loan provider; it’s a comprehensive financial wellness app that empowers users to take control of their finances. With quick, digital loans, robust privacy protections, and flexible financial solutions, LendMN is transforming the way Mongolians manage their money. Download LendMN today and experience the future of financial services in Mongolia.

- No virus

- No advertising

- User protection

Information

- File size: 66.10 M

- Language: English

- Latest Version: v3.2.7

- Requirements: Android

- Votes: 100

- Package ID: com.lendmn.lendmn

- Developer: LendMN

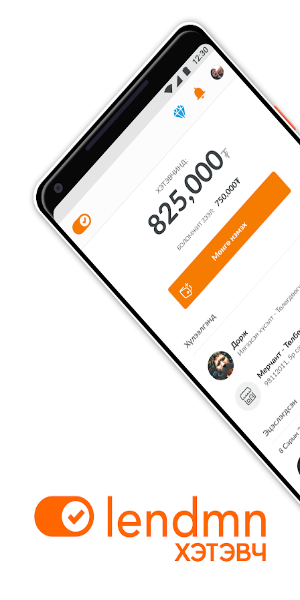

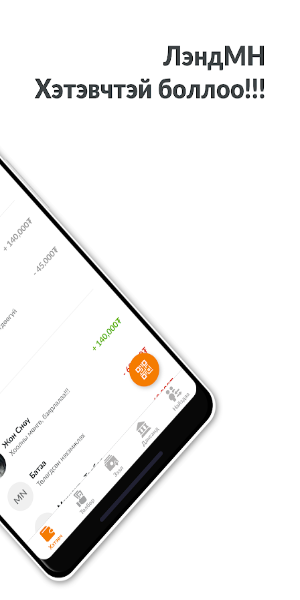

Screenshots

Explore More

Take charge of your finances anywhere with these top-rated money managers. Sleek budget planners help you curb splurges while investment trackers grow your wealth. Intuitive banking apps pay bills and transfer funds on the fly. Download now for an all-in-one personal finance solution. Stay on top of earnings, spending and more from your phone - be money-savvy wherever opportunity strikes!

Principles In Action

Paratic Haber: Ekonomi, Finans

Google Pay - a simple and secure payment app

Platform Residential

CA Mobile

Money manager & expenses

Accounting Basics

Bills Organizer -RemindonTime

Comment