Introduction

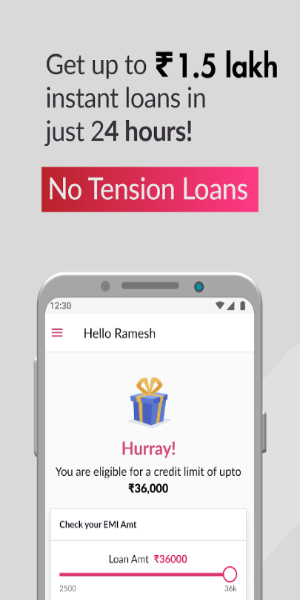

Discover NIRA Instant Personal Loan App, your go-to solution for instant personal loans in India. Designed to provide swift and convenient access to funds, NIRA collaborates with RBI-regulated NBFCs/Banks to ensure a seamless borrowing experience for salaried individuals in need.

Bring You Maximum Benefits:

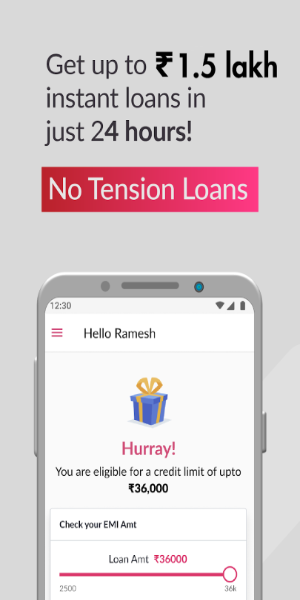

Instant Approval

Receive swift approval for personal loans, ensuring funds are disbursed promptly to address urgent financial needs. NIRA Instant Personal Loan App streamlines the approval process for quick access to funds precisely when required.

Tailor-Made Loan Amounts

Borrow according to your specific financial needs with customizable loan amounts. NIRA offers flexibility in loan disbursement, ensuring you can secure precisely the amount needed to cover expenses effectively.

Competitive Interest Rates

Benefit from competitive interest rates crafted to enhance affordability and manageability of loans. NIRA strives to provide rates that are competitive within the market, ensuring cost-effective borrowing solutions.

Convenient Repayment Plans

Select from a range of repayment options tailored to fit your budget and financial capabilities. NIRA ensures that repayment plans are flexible and convenient, allowing for seamless management of loan repayments without undue financial strain.

Getting the Most out of the App:

Ensuring Smooth Application

Verify Eligibility Criteria : Before proceeding with your loan application on the NIRA Instant Personal Loan App, it's crucial to review and confirm your eligibility criteria. This step ensures that you meet all requirements, facilitating a seamless and efficient application process.

Compare and Choose Wisely

Evaluate Loan Offers : Take the time to compare various loan offers available through NIRA, focusing on interest rates, repayment terms, and other conditions. This comparison allows you to select the most favorable option that aligns with your financial situation and borrowing needs.

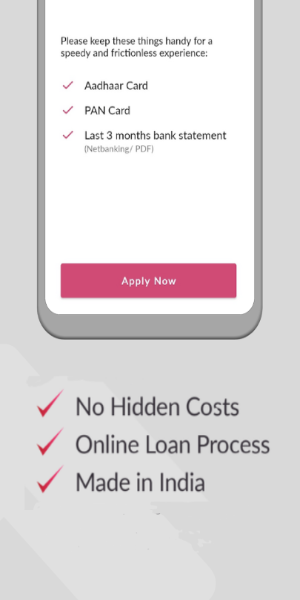

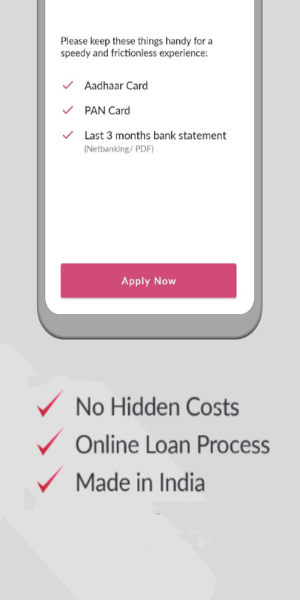

Document Submission Made Easy

Complete Document Submission : To expedite the approval of your loan application, ensure all required documents are submitted accurately and in full. This proactive approach minimizes delays and enhances the efficiency of the loan processing timeline.

Stay on Track

Monitor Your Repayment Schedule : Once your loan is approved and disbursed, stay vigilant about monitoring your repayment schedule. This diligence helps you stay organized, avoid missed payments, and maintain a positive credit profile, crucial for future financial endeavors.

Access Support When Needed

Utilize Customer Support : Should you have any questions or require assistance during the loan application or repayment process, don't hesitate to reach out to NIRA's customer support. Their dedicated team is available to provide guidance, address concerns, and ensure a smooth and satisfactory experience.

Conclusion:

NIRA Instant Personal Loan App stands as your trusted partner in securing quick and reliable personal loans in India. With seamless access to funds, competitive interest rates, and flexible repayment options, NIRA ensures your financial needs are met efficiently. Download NIRA now to experience the convenience of instant personal loans at your fingertips, empowering you to manage financial emergencies with ease.

- No virus

- No advertising

- User protection

Information

- File size: 60.68 M

- Language: English

- Latest Version: v7.6.8

- Requirements: Android

- Votes: 100

- Package ID: com.nirafinance.customer

- Developer: NIRA

Screenshots

Explore More

Explore our comprehensive collection of borrowing software, tailored to enhance financial solutions. These tools encompass diverse functionalities including loan management, borrower assessment, and financial analytics, offering robust support for borrowers and lenders alike.

View more

Comment