Introduction

Finnable is a versatile personal loan app designed for salaried professionals in India. Users can apply for quick, paperless loans ranging from ₹25,000 to ₹10,00,000, with flexible EMI options and transparent fees. The app offers a fully digital experience, allowing users to manage their loans easily and securely directly from their mobile devices.

Discover Finnable: Your Gateway to Seamless Personal Loans in India

In today’s fast-paced world, access to quick and hassle-free personal loans can be a game-changer. Finnable is emerging as a leading solution for salaried professionals across India, offering a modern approach to personal financing. This comprehensive guide explores how Finnable can streamline your borrowing experience with its innovative features and user-centric design.

Finnable: Revolutionizing Personal Loans in India

Finnable is transforming the landscape of personal finance in India. As a rapidly growing personal loan app, it caters specifically to salaried professionals in over 120 cities. Finnable is an RBI-licensed Non-Banking Financial Company (NBFC), committed to providing accessible and efficient financial solutions through a fully digital platform.

Key Features of Finnable

Diverse Loan Amounts: Finnable offers personal loans ranging from ₹25,000 to ₹10,00,000, allowing users to borrow according to their needs and financial situation.

Competitive Interest Rates: With interest rates between 16% and 35.99%, Finnable provides flexible borrowing options suited to various financial profiles.

Flexible Tenure Options: Choose a repayment period from 6 months to 60 months, giving you the freedom to select a tenure that fits your budget and repayment capabilities.

Transparent APR: The Annual Percentage Rate (APR) ranges from 0% to 41%, providing clear insight into the cost of borrowing.

100% Digital Application: The entire loan process is paperless, from application to disbursement, ensuring a convenient experience that you can manage anytime, anywhere.

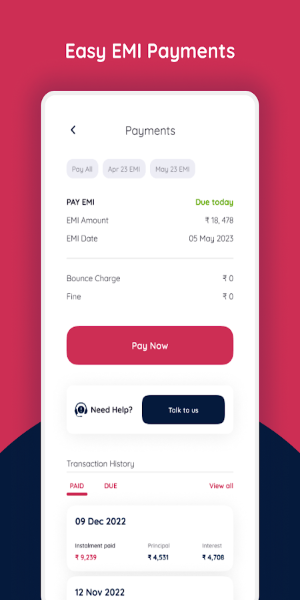

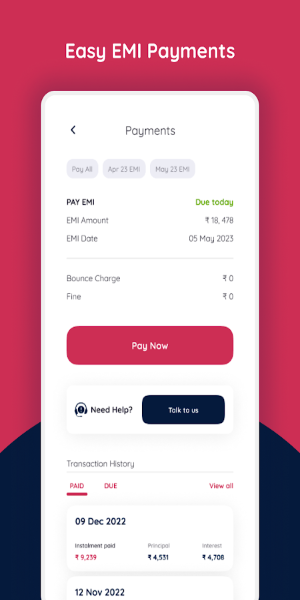

Flexible EMI Plans: Tailor your Equated Monthly Installments (EMIs) to what you can afford, making it easier to manage your repayments.

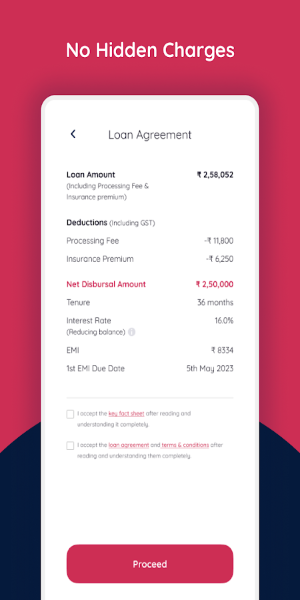

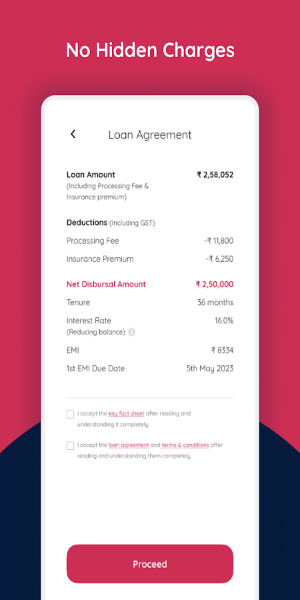

No Hidden Fees: Finnable emphasizes transparency with no hidden charges, ensuring that you only pay what is clearly outlined.

Eligibility Criteria: Who Can Apply?

To apply for a loan with Finnable, you must meet the following criteria:

Indian Residency: You must be a resident of India.

Full-Time Employment: Employed full-time with a monthly salary of ₹15,000 or more.

Bank Account: Your salary should be deposited directly into a bank account.

Example Loan Calculation: What to Expect

To illustrate how Finnable's loans work, here’s a representative example:

Loan Amount: ₹1,00,000

Interest Rate: 16% (on a reducing balance basis)

Repayment Tenure: 12 months

Processing Fee: 3% + GST

Final Processing Fee: ₹3,000 + ₹540

Total Loan Amount: ₹1,03,540

Amount Disbursed: ₹1,00,000

Monthly EMI: ₹9,394

Total Interest: ₹9,191

APR: 21.97%

Total Repayment Amount: ₹1,12,731

This example provides a clear picture of the loan costs, including interest and processing fees, allowing you to plan your finances accordingly.

Responsible Lending: Partnering with Trusted NBFCs

Finnable partners with leading RBI-regulated NBFCs to ensure security and compliance:

Finnable Credit Private Limited

DMI Finance Private Ltd

Northern Arc Capital Limited

Utkarsh Small Finance Bank Limited

TVS Credit Services Limited

Piramal Capital & Housing Finance Limited

These partnerships guarantee that your loan is managed securely and in line with regulatory standards.

Security and Privacy: Protecting Your Information

Finnable is committed to safeguarding your personal data. Here’s how we ensure your privacy:

Data Security: Your information is never shared with third parties.

Permissions Needed:

SMS: To enhance app functionality and prevent fraud.

Location: To verify your address.

Camera & Media: To upload necessary documents like Aadhaar/PAN.

Device Info: To secure your application by linking your phone’s unique ID.

These measures protect your data and ensure a secure borrowing experience.

The Finnable Advantage: Why Choose Us?

Finnable distinguishes itself with its rapid processing, transparent operations, and flexible terms. Here’s why it’s a top choice for personal loans:

Quick Disbursement: Receive funds in your bank account within hours of approval.

Transparent Costs: No hidden fees and clear APR provide peace of mind.

Flexible Terms: Choose repayment options that fit your financial situation.

Simplify Your Financial Life with Finnable

Finnable offers a modern, efficient, and user-friendly solution for personal loans in India. With its digital application process, flexible terms, and commitment to transparency, Finnable empowers you to manage your finances with ease. Whether you need a quick loan to cover an unexpected expense or are planning a major purchase, Finnable is your trusted partner in financial flexibility. Download Finnable today and experience the convenience of managing your personal loans with confidence and simplicity.

- No virus

- No advertising

- User protection

Information

- File size: 45.62 M

- Language: English

- Latest Version: v5.1.0f

- Requirements: Android

- Votes: 100

- Package ID: com.finnable.customer

- Developer: Finnable

Screenshots

Explore More

Entertain yourself endlessly on the go for zero cost! Packed with movies, shows, music and videos from around the world, these top-rated media apps will keep you engrossed for hours. Stream your favorite channels and playlists ad-free or download your favorites for offline viewing later. Download now to turn your phone into an unlimited personal theater - and enjoy premium entertainment that won’t drain your budget.

Biblia Católica Español

Radios de Costa Rica Online

Android Auto – Google Maps, Media & Messaging

Love status

TestMaker

Banner Maker, Thumbnail Maker

AOTrauma Orthogeriatrics

Washington Post

Comment