Introduction

Loaney stands out as the premier choice for quick personal loans, offering instant approvals and seamless online application processes that culminate in direct bank transfers within minutes. With competitive interest rates and a commitment to enhancing credit scores through timely repayments, Loaney revolutionizes the lending experience with 24x7 accessibility, ensuring rapid approval compared to conventional banking procedures.

Powerful Functions of Loaney – Instant Personal Loan:

- Discover the ultimate solution for accessing emergency funds effortlessly, without the need for collateral.

- Manage your expenses seamlessly with a streamlined, digital documentation process that ensures a secure transaction.

- Resolve overdue bills promptly with immediate approval, regardless of your CIBIL score status.

- Loaney has revolutionized the process of applying for and receiving personal loans, making it remarkably straightforward and user-friendly.

- Experience unparalleled flexibility with our personal loan app in India, offering heightened transparency and robust security measures.

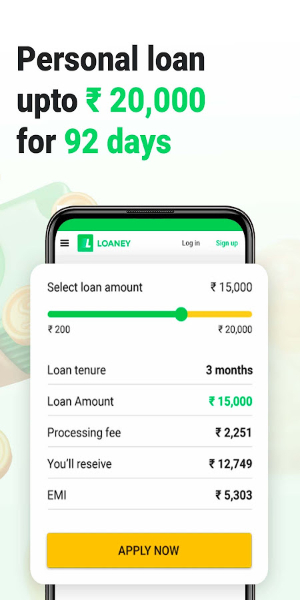

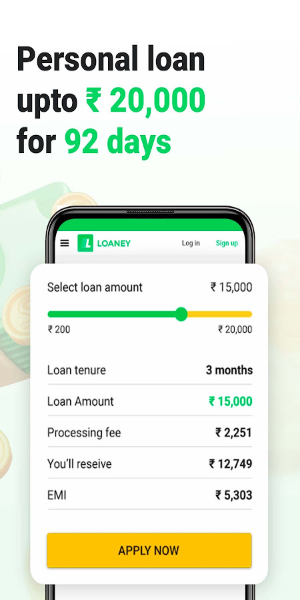

- Access instant personal loans ranging from ₹200 to ₹20,000, featuring competitive interest rates tailored to meet your financial needs.

Loaney operates exclusively through a digital platform, facilitating immediate disbursal of personal loans directly into your bank account.

Below are the Essential Eligibility Requirements for Swiftly Applying for a Loan Via Our App:

- Applicants must possess

- Our personal loan offerings are accessible to individuals who meet specified criteria related to their credit history or income.

- Applicants must fall within a specified age bracket

- Possess an active bank account

More Details:

Loaney ensures the highest standards of security and privacy in handling customer data, storing all information on servers based in India. In collaboration with an NBFC registered with RBI under registration number 13.00722, Loaney offers seamless access to small personal loans ranging from ₹200 to ₹20,000, with instant approval typically granted within 2 minutes:

- Annual Interest Rate: 36%

- Processing Fee (inclusive of GST): 15%

- Loan Information, Repayment, and Disbursement: Free

- Early Repayment Penalty and Payment Schedule: None

- Minimum Repayment Period (Tenure): 92 days

- Maximum Repayment Period (Tenure): 92 days

- Late Repayment Fee: 18% of the overdue principal amount (capped at 18% of the loan amount)

For instance, borrowing ₹1000 for 3 months would entail repayments of ₹354, ₹354, and ₹353, respectively, with a processing fee of ₹149 deducted from the loan amount before disbursement. The total amount repayable would be ₹1061 over the 92-day tenure. The maximum APR stands at 36%.

Use Loaney Now!

Explore Loaney for a revolutionary approach to borrowing through a fully digital process that eliminates traditional paperwork.

1. Download the app with a simple click.

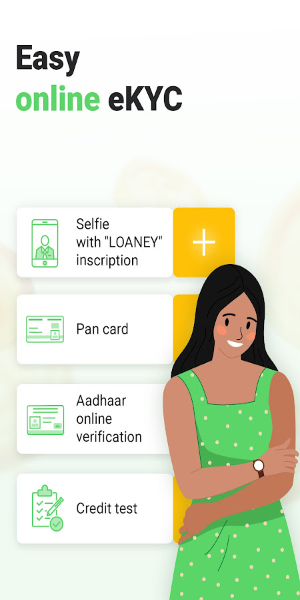

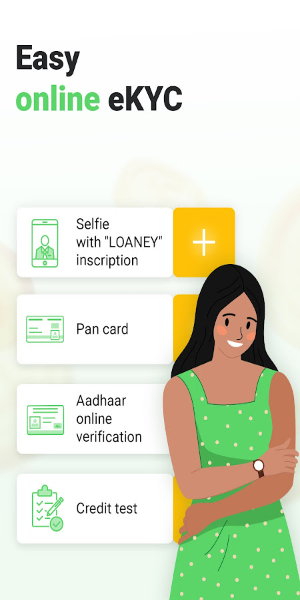

2. Sign up and create your account: provide personal details and verify your mobile number.

3. Submit your Aadhaar Card and PAN Card online.

4. Choose your desired personal loan option and proceed with the application.

5. Receive approval within 2 minutes of submission.

6. Enjoy direct transfer of your selected personal loan to your bank account within 10 minutes.

- No virus

- No advertising

- User protection

Information

- File size: 3.24 M

- Language: English

- Latest Version: v1.0.5

- Requirements: Android

- Votes: 100

- Package ID: es.loaney.app

- Developer: Ferrymill Financial Technology Private Limited

Screenshots

Explore More

Entertain yourself endlessly on the go for zero cost! Packed with movies, shows, music and videos from around the world, these top-rated media apps will keep you engrossed for hours. Stream your favorite channels and playlists ad-free or download your favorites for offline viewing later. Download now to turn your phone into an unlimited personal theater - and enjoy premium entertainment that won’t drain your budget.

NBC 5 Chicago

Football Logo Maker

Card Maker For PKM

HandWriting Font Maker

Before and after: side by side

Rus.TVNET

MK AIMentor

Video Downloader & Video Saver

Comment