Introduction

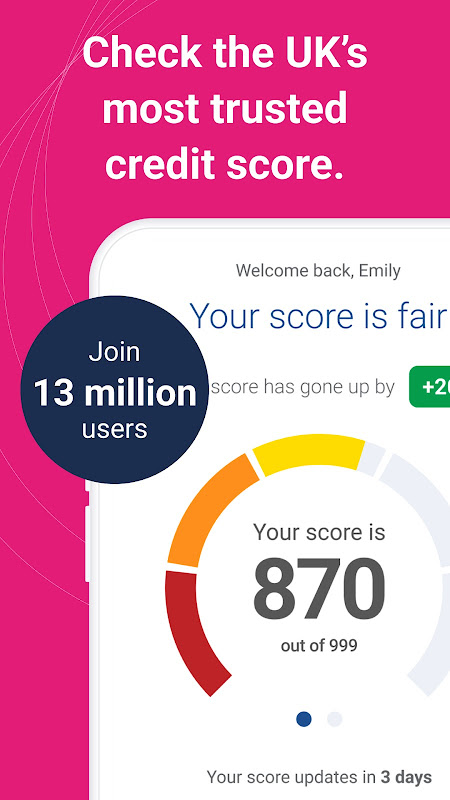

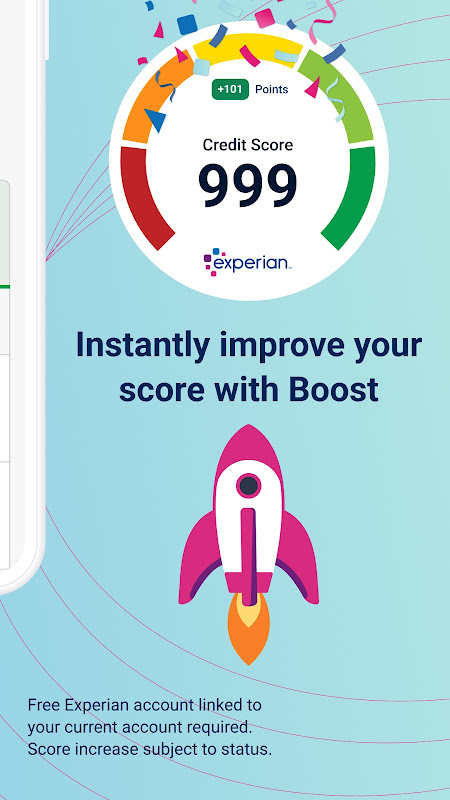

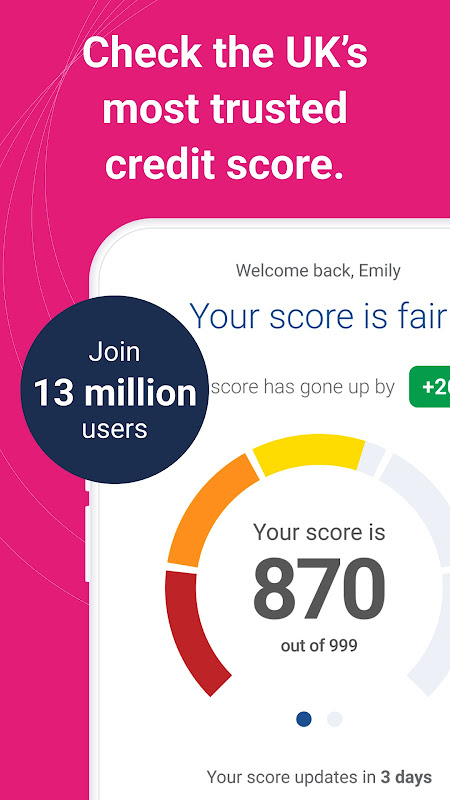

The UK's most trusted credit score* is available for free. Get free access to a wide range of our services, from credit score checks, credit card comparison & eligibility and personal loan comparison & eligibility.

Experian Credit Score: Your Key to Financial Health

Hey there! Curious about your credit score and what it means for your financial future? Let me introduce you to Experian Credit Score—a powerful tool that gives you insights into your creditworthiness and empowers you to make informed financial decisions.

Here’s everything you need to know:

Your Experian Credit Score is a straightforward way of showing how lenders may view your application. As part of a credit check, companies may look at whether you’ve paid back your credit on time, how much credit you currently have and how you’re managing it.

The better your credit score the better your chances are of getting a credit card, loan or even a mortgage, along with great rates for each.

Understanding Your Experian Credit Score

Your Experian Credit Score is a three-digit number that reflects your creditworthiness based on your credit history. It’s a crucial factor that lenders use to assess your risk level when you apply for loans, credit cards, mortgages, and other financial products. The higher your score, the better your chances of getting approved for favorable terms.

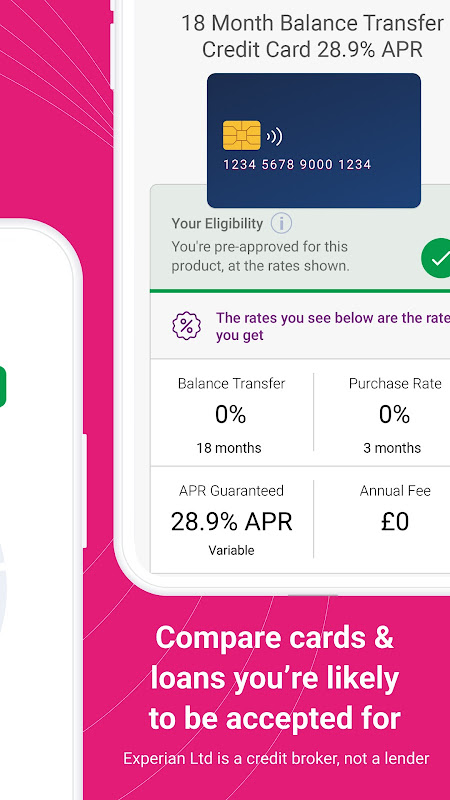

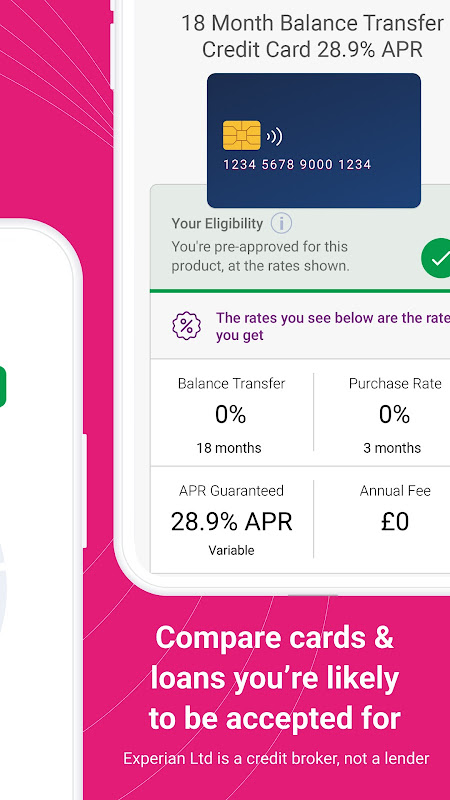

Compare credit cards and loans with us. Let Experian help by showing you the credit cards and personal loans you’re most likely to be accepted for, helping you save hassle and avoid too many unsuccessful applications impacting your credit rating.

Experian is a credit broker not a lender†, so we show you impartial search results.

Free Experian account features:

• Your Experian Credit Score on the go

• Credit card and loan comparison

• Summary of your total credit

• See how likely you are to get accepted for personal loans and credit cards before applying

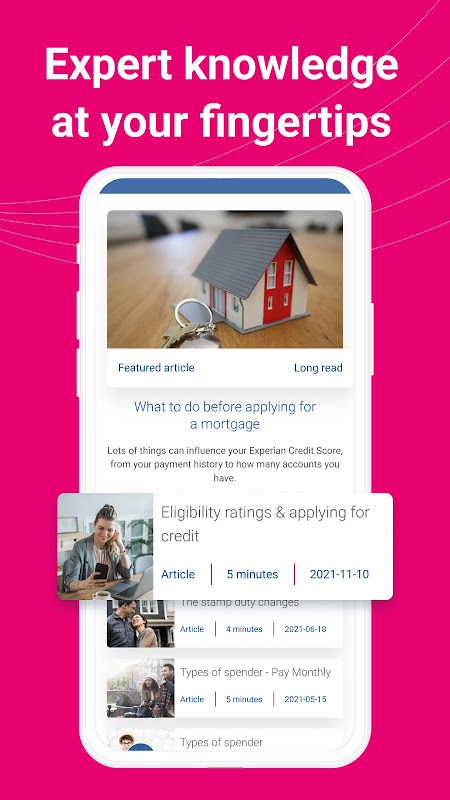

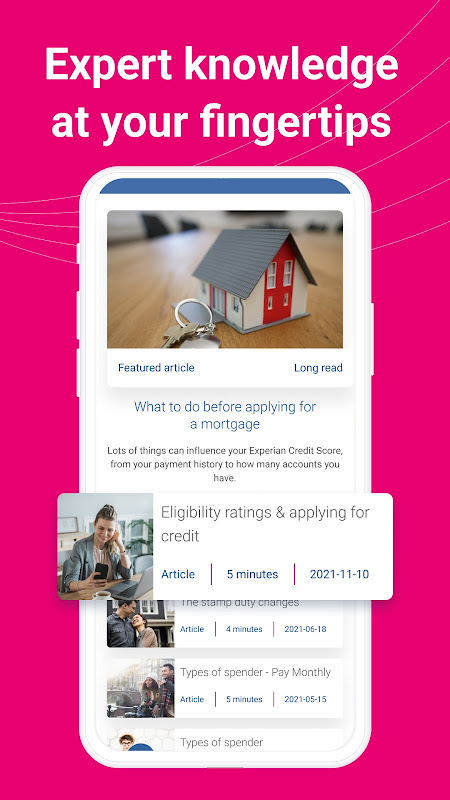

• Tips, articles, videos and expert knowledge to improve your suitability for credit checks at your fingertips

• Quick and easy login with fingerprint or PIN

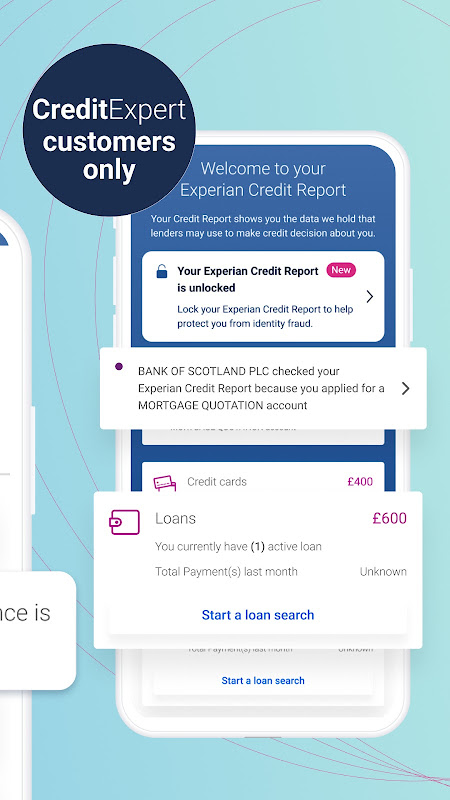

CreditExpert subscribers get access to these additional features:

• Personalised tips on how to improve your credit score

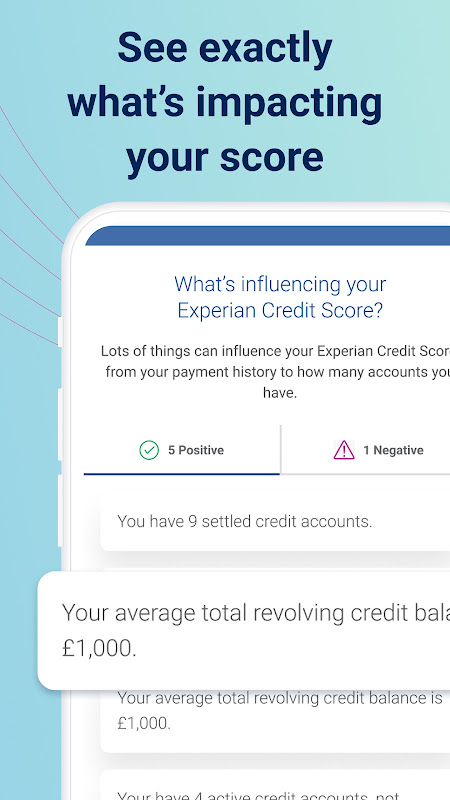

• Score Influencers show you what’s positively and negatively affecting your Experian Credit Score

• Get your Experian Credit Score & Report updated daily

• Alerts notify of you credit score changes

• UK call support for credit report & score

• Timeline shows you a single view of your score history and alerts

• Web monitoring

• Dedicated fraud support

Checking your Experian Credit Score regularly won't affect your credit report or credit rating. What's more, the app search covers a range of selected credit cards and loans.

App is not designed for tablets at this time.

Why Your Credit Score Matters

Your credit score isn’t just a number—it’s a key determinant of your financial health. A good credit score can help you qualify for lower interest rates, higher credit limits, and better loan terms. It’s also important for renting apartments, securing insurance premiums, and even landing certain jobs.

Monitoring and Managing Your Score

Experian provides tools and resources to help you monitor and manage your credit score effectively. You can access your score regularly through Experian’s website or mobile app, track changes over time, and receive alerts about important updates or potential fraud incidents.

Factors Influencing Your Credit Score

Several factors influence your Experian Credit Score, including your payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent credit inquiries. Understanding these factors empowers you to take proactive steps to improve your score.

Credit Education and Tips

Experian offers educational resources and personalized tips to help you improve and maintain your credit score. Whether you’re working to build credit from scratch, recover from past financial challenges, or simply want to optimize your score, Experian provides guidance tailored to your unique financial situation.

Credit Monitoring Services

Protecting your credit is paramount. Experian’s credit monitoring services help detect potential fraud and identity theft early by alerting you to suspicious activity on your credit report. Prompt action can minimize damage and help you safeguard your financial reputation.

Building a Bright Financial Future

Your Experian Credit Score isn’t just about today—it’s about laying the groundwork for a secure financial future. By responsibly managing your credit and staying informed with Experian’s tools, you can unlock opportunities, achieve financial goals, and enjoy peace of mind knowing you’re in control of your credit journey.

Conclusion

In conclusion, your Experian Credit Score is a valuable asset that impacts many aspects of your financial life. Whether you’re planning for a major purchase, applying for a loan, or simply want to maintain a healthy credit profile, Experian provides the tools and expertise to help you navigate the complexities of credit with confidence.

Ready to take charge of your credit score?

Discover the power of Experian Credit Score today and embark on a path to financial success!

- No virus

- No advertising

- User protection

Information

- File size: 36.00 M

- Language: English

- Latest Version: v6.32.0

- Requirements: Android

- Votes: 100

- Package ID: net.intellectsoft.experian

- Developer: Experian Mobile

Screenshots

Explore More

Level up your phone with the most helpful tools for Ultimate productivity. From image editors and file managers to task trackers and weather widgets, these top-rated essentials make everyday tasks smooth and easy. Get organized, save time and optimize workflows with a powerful toolbox by downloading these editor's choice utilities today. Your phone will never be the same again!

新北校園通

قرآن | ورش التجويد

Mockitup

Headify: AI Headshot Generator

Body Editor - AI Photo Editor

Utah Hunting and Fishing

Coral Travel - турагентство

geteduroam

Comment