Introduction

EMI Home Loan Calculator is a versatile financial app that streamlines loan management. Users can calculate EMIs for various loans, check eligibility for home and personal loans, and manage banking calculations like FD and RD returns. The app also offers documentation checklists and a FAQ section to simplify financial planning and loan applications.

Complete Guide to EMI Home Loan Calculator

In today's fast-paced world, managing your finances efficiently is crucial, and the EMI Home Loan Calculator app emerges as an indispensable tool in achieving this. Designed to function as a mini-bank in the palm of your hand, this app provides comprehensive financial calculations, making it easier to assess loan eligibility and manage various financial products without the need to visit a branch. Here’s an in-depth look at what this app has to offer.

Overview of EMI Home Loan Calculator

EMI Home Loan Calculator is a robust and versatile application aimed at simplifying your financial planning. From calculating Equated Monthly Installments (EMIs) for different types of loans to assessing eligibility and managing deposits, this app serves as an all-in-one financial tool. It eliminates the need for physical branch visits, providing a seamless experience for users to handle their financial calculations and documentation.

Key Features of EMI Home Loan Calculator

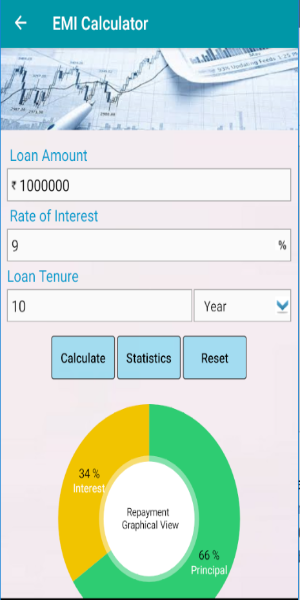

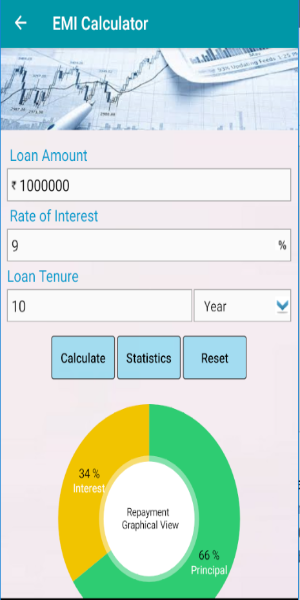

1. EMI Calculation for Various Loans

One of the core functionalities of the EMI Home Loan Calculator is its ability to calculate EMIs for various types of loans. Whether you are considering a home loan, car loan, or any other type of loan, the app provides accurate EMI calculations. Users can input the loan amount, interest rate, and loan tenure to instantly see the EMI amount, making it easier to plan and budget for their financial commitments.

2. Loan Eligibility Assessment

The app extends beyond simple EMI calculations by offering tools to check loan eligibility. Users can assess their eligibility for different loan types including:

Home Loan: Evaluate your eligibility for purchasing a new home.

Car Loan: Determine how much you can borrow for a car purchase.

Top-Up Loan: Check eligibility for additional financing on an existing loan.

Personal Loan: Assess eligibility for personal financing needs.

Loan Against Property: Calculate eligibility for loans secured against property.

Pension Loan: Evaluate options for loans available to pensioners.

By providing these eligibility checks, the app helps users understand their borrowing capacity and make informed financial decisions.

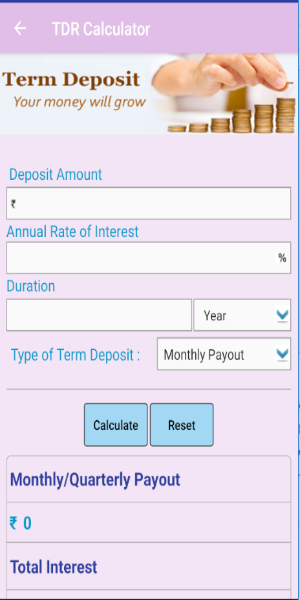

3. Comprehensive Banking Calculations

The app features a section dedicated to banking calculations, which includes:

FD Calculator: Calculate returns on Fixed Deposits (FDs) based on the deposit amount, interest rate, and tenure.

RD Calculator: Estimate returns on Recurring Deposits (RDs) with similar inputs.

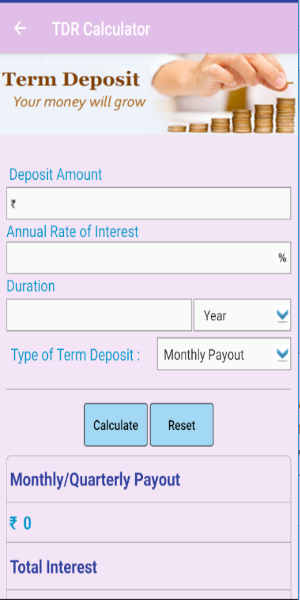

TDR Calculator: Determine returns on Term Deposits Receipts (TDRs), aiding users in planning their investment strategies.

These tools are invaluable for users looking to manage their savings and investment portfolios efficiently.

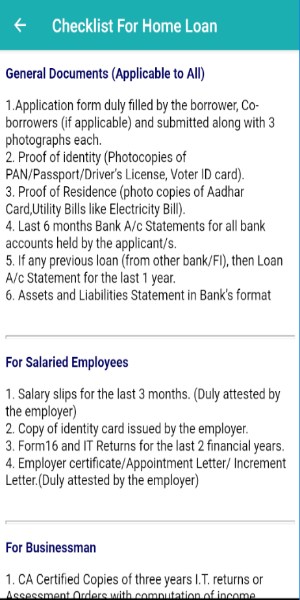

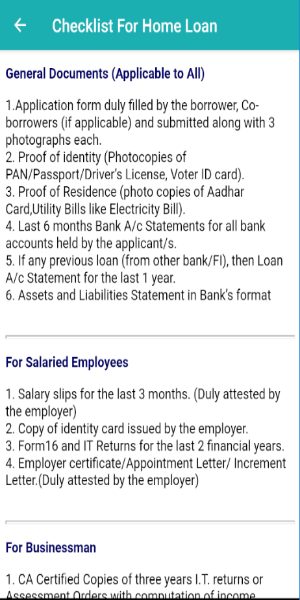

4. Loan Documentation Checklist

Gone are the days of visiting a branch to inquire about necessary documents for loans. The EMI Home Loan Calculator app includes a comprehensive checklist for various loan types:

Home Loan: A detailed list of documents required for applying for a home loan.

Education Loan: Documentation requirements for loans aimed at financing education.

Car Loan: Necessary documents for car loan applications.

This feature streamlines the application process by providing users with a clear understanding of what is needed, reducing the hassle of gathering documents.

5. Frequently Asked Questions (FAQ) Section

To assist users in understanding the complexities of loans and related financial products, the app includes a FAQ section. This section provides:

Basic Information: Answers to common questions about home loans and other financial products.

Pradhan Mantri Awas Yojana (PMAY): Information about this government scheme aimed at providing affordable housing.

The FAQ section is designed to clarify doubts and provide valuable insights, ensuring users are well-informed about their financial options.

How to Use EMI Home Loan Calculator

Step-by-Step EMI Calculation

Open the App: Launch the EMI Home Loan Calculator app on your device.

Select Loan Type: Choose the type of loan you wish to calculate, such as home loan, car loan, etc.

Enter Loan Details: Input the loan amount, interest rate, and tenure.

Calculate EMI: Tap on the calculate button to view your EMI amount.

Checking Loan Eligibility

Navigate to Eligibility Section: Access the eligibility assessment feature in the app.

Select Loan Type: Choose the type of loan for which you want to check eligibility.

Enter Personal Details: Provide necessary details such as income, existing loans, and other relevant information.

View Results: The app will display your eligibility status based on the inputs provided.

Using Banking Calculators

Select Calculator Type: Choose between FD, RD, or TDR calculators.

Input Details: Enter the deposit amount, interest rate, and tenure.

Calculate Returns: View the estimated returns on your deposits.

Accessing Documentation Checklists

Go to the Checklist Section: Find the documentation section in the app.

Choose Loan Type: Select the type of loan you are interested in.

Review Checklist: View the list of documents required for your loan application.

Benefitsof Using EMI Home Loan Calculator

Convenience: Access all necessary financial tools from a single app without the need to visit a bank.

Efficiency: Quickly calculate EMIs, check loan eligibility, and manage deposits with ease.

Comprehensive Information: Gain insights into loan documentation and government schemes through the app’s FAQ section.

Accuracy: Rely on precise calculations and up-to-date financial information to make informed decisions.

Don't Wait - Try EMI Home Loan Calculator Today!

The EMI Home Loan Calculator app is an essential financial tool for anyone looking to manage their loans and investments effectively. With its wide range of features, including EMI calculations, loan eligibility assessments, and banking calculators, this app offers a one-stop solution for all your financial needs. Its user-friendly interface and comprehensive documentation support ensure a smooth and informed financial planning experience. Whether you’re applying for a new loan or managing existing financial products, this app provides the tools and information necessary to make confident financial decisions.

- No virus

- No advertising

- User protection

Information

- File size: 113.59 M

- Language: English

- Latest Version: v2024.04.01

- Requirements: Android

- Votes: 100

- Package ID: com.hu.tech.loan

- Developer: Hu Tech

Screenshots

Explore More

Level up your phone with the most helpful tools for Ultimate productivity. From image editors and file managers to task trackers and weather widgets, these top-rated essentials make everyday tasks smooth and easy. Get organized, save time and optimize workflows with a powerful toolbox by downloading these editor's choice utilities today. Your phone will never be the same again!

Elra

Take and Go

UK Newspapers

NBC 5 Chicago

Etransport

Learn German Fast: Course

Football Logo Maker

Make A Wish Come True Genie

Comment