Introduction

VA Loans - FAQ & Tips is a comprehensive app designed for veterans seeking affordable loan options. Users can easily apply for VA loans, compare lenders, manage debt, and check eligibility. The app also offers budgeting tips and insights into the latest trends, ensuring that veterans have the tools and information needed for effective financial planning.

VA Loans - FAQ & Tips: Your Comprehensive Guide to Veteran Financing

Are you a veteran seeking affordable and accessible loans to meet your financial needs? Look no further than VA Loans - FAQ & Tips! This app is designed specifically to assist veterans in securing the financial support they need with ease and confidence. Our commitment to providing veterans with competitive loan options sets us apart, ensuring that you receive the best possible service tailored to your unique needs.

Explore the Benefits of VA Loans for Veterans

VA Loans - FAQ & Tips offers a range of benefits designed to make financial assistance accessible and affordable for veterans:

Lower Interest Rates and Flexible Repayment Options: Veterans can take advantage of lower interest rates compared to traditional loans, which can lead to significant savings over time. The app also offers flexible repayment options to accommodate different financial situations and preferences.

Quick and Easy Online Application Process: Applying for a VA loan is streamlined through the app's user-friendly interface. The online application process is efficient, allowing veterans to submit their information and documents quickly and securely.

No Hidden Fees or Prepayment Penalties: VA Loans - FAQ & Tips ensures transparency by eliminating hidden fees and prepayment penalties. This means you can manage your loan without worrying about unexpected costs or being penalized for paying off your loan early.

Applying for VA Loans as a Veteran

Applying for a VA loan through the app is a straightforward process. Follow our step-by-step guide to ensure a smooth application experience:

Gather Required Documents: Prepare your documentation, including proof of military service, income verification, and identification.

Fill Out the Application: Enter your personal and financial details into the app's secure application form.

Submit Your Application: Review your information for accuracy and submit your application through the app.

Await Approval: Once submitted, the app will provide updates on the status of your application.

Receive Funds: Upon approval, funds will be disbursed according to the terms of your loan.

Consolidate and Manage Debt with VA Loans

VA Loans can be a valuable tool for veterans looking to consolidate existing debt and improve their financial health. The app provides guidance on how to use VA loans for debt consolidation:

Combine Multiple Debts: Use VA loans to pay off various types of debt, such as credit cards and personal loans, simplifying your financial obligations.

Lower Monthly Payments: By consolidating debt through a VA loan, you may benefit from lower monthly payments and a more manageable repayment schedule.

Improve Financial Status: Consolidating debt can also help improve your credit score and overall financial status by reducing outstanding balances and simplifying your finances.

VA Loans vs Traditional Loans

Understanding the differences between VA loans and traditional loans can help you make an informed decision. Here’s a comparison of key factors:

Interest Rates: VA loans typically offer lower interest rates compared to traditional loans, resulting in lower overall borrowing costs.

Collateral Requirements: Unlike traditional loans, VA loans often do not require collateral, making them more accessible to veterans who may not have significant assets.

Eligibility Criteria: VA loans have specific eligibility requirements based on military service, whereas traditional loans may have broader criteria.

Fees and Penalties: VA loans are designed to be transparent, with no hidden fees or prepayment penalties, unlike some traditional loan options.

Top VA Loans Lenders

Choosing the right lender is crucial for obtaining the best loan terms. Our app provides a rundown of the top VA loan lenders, including:

Lender Profiles: Detailed information on each lender, including interest rates, terms, and customer satisfaction ratings.

Comparison Tools: Compare lenders based on key criteria to find the best fit for your needs.

Customer Reviews: Read reviews and ratings from other veterans to gauge the quality of service provided by different lenders.

Tips for Budgeting with VA Loans

Effective budgeting is essential for making the most of your VA loan. The app offers valuable tips and strategies for managing your finances:

Create a Budget: Develop a detailed budget that includes your monthly loan payments, living expenses, and savings goals.

Track Your Spending: Monitor your spending habits to ensure you stay within your budget and avoid unnecessary debt.

Plan for Repayments: Allocate funds for your loan repayments in advance to ensure timely payments and avoid late fees.

Are You Eligible for VA Loans?

Before applying for a VA loan, it’s important to determine if you meet the eligibility requirements. The app provides a simple eligibility check to help you:

Verify Military Service: Confirm your eligibility based on your military service history.

Check Financial Criteria: Ensure you meet the financial requirements for a VA loan.

Get Instant Results: Use the app to quickly check your eligibility status and receive guidance on next steps.

Beginner’s Guide to VA Loans

If you’re new to VA loans, our app offers a comprehensive guide to help you understand the basics:

What are VA Loans?: Learn about the purpose and benefits of VA loans for veterans.

How They Work: Understand the loan process, including application, approval, and repayment.

Why They’re a Great Option: Discover the advantages of VA loans and how they can benefit your financial situation.

Don't Miss Out - Download Now and Start Your Journey!

VA Loans - FAQ & Tips is your go-to resource for understanding and managing VA loans. With its user-friendly interface, comprehensive features, and valuable insights, the app is designed to provide veterans with the best possible service and support. Whether you’re applying for a loan, consolidating debt, or simply exploring your options, VA Loans - FAQ & Tips ensures that you have the information and tools you need to make informed financial decisions.

Download VA Loans - FAQ & Tips today and take the first step towards achieving your financial goals with confidence and ease!

- No virus

- No advertising

- User protection

Information

- File size: 8.82 M

- Language: English

- Latest Version: v100.0

- Requirements: Android

- Votes: 100

- Package ID: com.proyectoultra70

- Developer: Things To Do

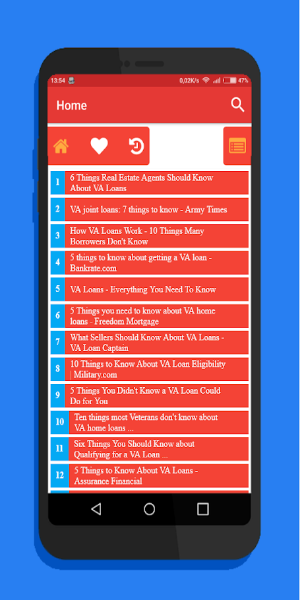

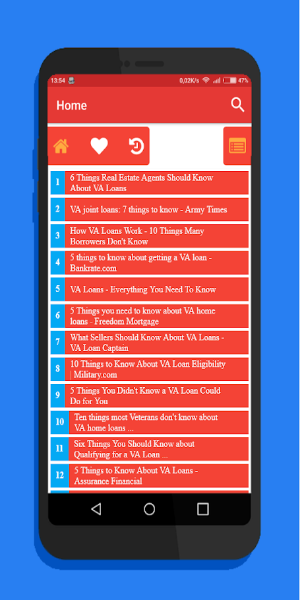

Screenshots

Explore More

Level up your phone with the most helpful tools for Ultimate productivity. From image editors and file managers to task trackers and weather widgets, these top-rated essentials make everyday tasks smooth and easy. Get organized, save time and optimize workflows with a powerful toolbox by downloading these editor's choice utilities today. Your phone will never be the same again!

新北校園通

قرآن | ورش التجويد

Mockitup

Headify: AI Headshot Generator

Body Editor - AI Photo Editor

Utah Hunting and Fishing

Coral Travel - турагентство

geteduroam

Comment