Introduction

Bridge2Capital is a dedicated mobile app crafted specifically for small businesses across India. With a comprehensive approach to financial health, our platform offers a wide array of on-demand financial services. Our mission is to foster economic growth at the grassroots level by bridging the gap between financial resources and technological empowerment for small enterprises in towns and cities throughout India.

Discover the Enchantment of Bridge2Capital:

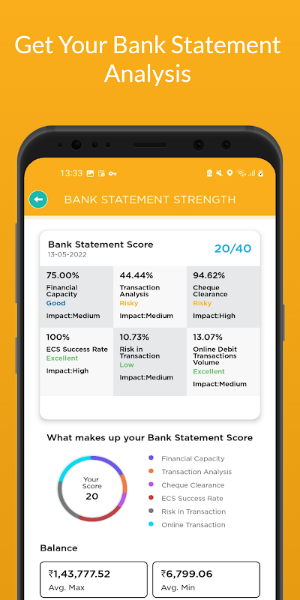

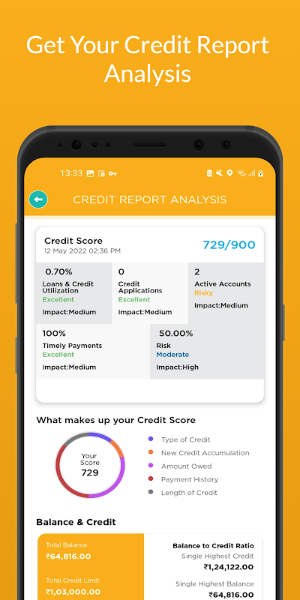

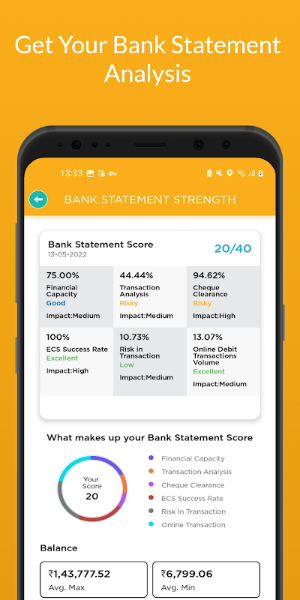

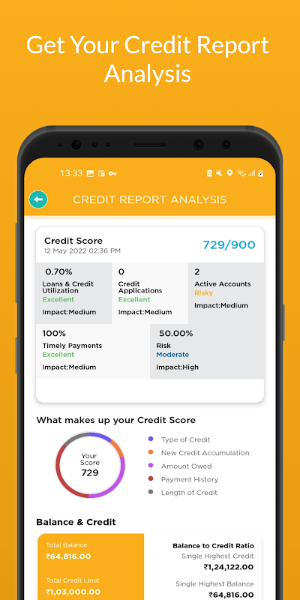

1. 360° Financial Health Check

At Bridge2Capital, we offer a comprehensive paid service designed to assess the financial health of small businesses. Our thorough analysis includes reviewing credit bureau reports, bank statements, and GST data. We provide a detailed report covering 15 key parameters that reflect the financial behavior and overall health of small business owners.

2. Digital Hissab

Our Digital Hissab serves as a modern bahi khata for small businesses, allowing them to manage day-to-day transactions directly from their smartphones. Users can access their accounts anytime, categorize transactions (such as owner, customer, etc.), and generate daily reports. It enables easy communication with transaction partners, setting payment reminders, and saving digital copies of receipts for future reference.

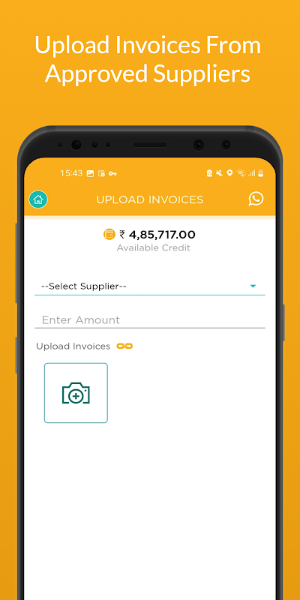

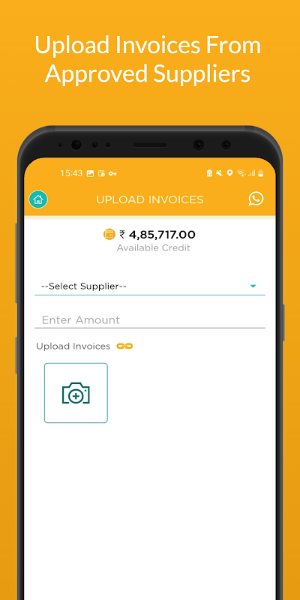

3. Business Loan Solutions

Bridge2Capital operates on a B2B model, offering short-term unsecured business loans (working capital limits) to small businesses in partnership with IIFL. Our innovative approach includes invoice financing and ensuring 100% utilization of funds. Loans are tailored based on our 360° FHC analysis, providing insights into the creditworthiness of business owners. We emphasize transparency by disbursing funds directly to GST-registered suppliers against presented invoices. Flexible repayment options are available, allowing businesses to repay loans in various tenures up to 180 days, enabling owners to focus on expanding their business turnover. Please note, we do not offer personal loans.

4. Digital Savings

Bridge2Capital simplifies daily savings with our Digital Savings feature, tailored for Digital Dukandaars. Customers can start saving in 99.99% pure 24K gold with just Rs. 10. Easily buy and sell gold through our platform with zero charges. You can also opt to have your gold delivered as coins or jewelry directly from our application, offering convenience and flexibility in your savings journey.

Product Details:

- Credit Limit: From ₹ 100,000 to ₹ 3,000,000

- Credit Term: Up to 180 days

- Repayment Flexibility: Flexible repayment options

- Annual Interest Rate: 18% to 24% with daily compounding

Illustrative Example of Bridge2Capital’s Business Loan Structure

1. Business Loan Example

- Credit Limit: ₹ 100,000

- Credit Period per Invoice: 30 days

- Repayment Schedule: Flexible

2. Invoice Financing Details

Invoice 1:

- Amount: ₹ 10,000

- Interest Rate: 24% per annum

- Term: 30 days

- Weekly EMI: ₹ 2,500

- Total Interest Paid: ₹ 115.43 (computed on a daily reducing basis)

- Total Amount Paid: ₹ 10,115.43

Invoice 2:

- Amount: ₹ 50,000

- Interest Rate: 24% per annum

- Term: 30 days

- Weekly EMI: ₹ 12,500

- Total Interest Paid: ₹ 556.60 (computed on a daily reducing basis)

- Total Amount Paid: ₹ 50,556.60

In a Word, Bridge2Capital enhances the consumer experience by offering comprehensive 360-degree FHC evaluations and short-term business loans tailored for retailers. These financial solutions empower businesses to bolster their inventory levels effectively. Moreover, Bridge2Capital is committed to delivering a seamless online experience through its digital ecosystem. This platform supports retailers in managing everything from collecting payments to making transactions, ensuring a streamlined and efficient operational process.

- No virus

- No advertising

- User protection

Information

- File size: 12.80 M

- Language: English

- Latest Version: v4.4.2

- Requirements: Android

- Votes: 100

- Package ID: com.bridge2capital

- Developer: XTRACAP FINTECH

Screenshots

Explore More

Stay connected wherever you roam with the best communication apps - absolutely free! Chat with friends on popular messengers, video call grandparents, message clients and more. With features like group chat, stickers, phone calls and HD video, you can easily collaborate on projects or share life's moments on the go. Download now to conveniently connect with loved ones without spending a dime!

Stipop

EssayPro

Group Sharing

Animated Sticker For WhatsApp

Real Messenger

Learn Turkish - 50 languages

Date in Australia: Chat & Meet

TalkMate

Comment