Introduction

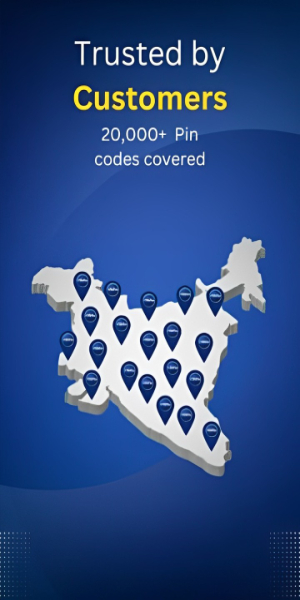

ClikFin offers an innovative online platform for instant personal loans. Partnering with NBFCs and trusted lenders, we provide swift access to funds directly deposited into your bank account, tailored for salaried individuals. Enjoy the convenience of a fully digital process with no paperwork or physical documentation required. Access funds swiftly and securely, anytime and anywhere, ensuring a seamless borrowing experience.

Why Opt for ClikFin?

- Swift access to online loans

- Competitive interest rates

- Effortless application process

- Rapid loan approval

- Fully digital processing

- Convenient EMIs for loan repayment

We offer hassle-free personal loans to individuals across various professions, including teachers, software engineers, accountants, retail employees, nurses, and more, provided they earn a minimum monthly salary of Rs.25,000.

Key Points:

- Annual Percentage Rates (APR): Ranging from 18% to 32% annually.

- Maximum APR Limit: Up to 32%.

- Loan Repayment Duration: Flexible terms ranging from 6 to 60 months.

- Processing Fees: A nominal fee of 2-4% based on the loan amount.

Clikfin's Quick Personal Loans Cater to a Variety of Needs:

- Financing home construction and renovations

- Covering expenses for family functions and weddings

- Supporting self-improvement initiatives like skill-training courses and job-related purchases

- Addressing medical emergencies

- Funding travel plans

- Assisting in purchasing two-wheelers

- Facilitating electronic purchases

- Consolidating multiple loans into a single manageable payment

How ClikFin Operates:

- Download and Sign in: Begin by downloading the app and logging in to your account.

- Enter Loan Details and Employment Information: Provide necessary details about your loan requirements and employment status.

- Upload KYC Documents: Submit essential documents such as AADHAAR card, PAN card, and a photograph for verification.

- Approval Notification: Receive approval confirmation within 24 hours of document submission.

- Loan Agreement Processing: Once approved, the loan agreement will be processed, and the loan amount disbursed accordingly.

- Manage EMIs: After disbursal, ensure timely repayment of EMIs according to the scheduled due dates.

Loan Approval Requirements:

- Income-to-Expense Ratio: Demonstrating a balanced financial profile with manageable expenses relative to income.

- Demographic Factors: Considerations include age, marital status, and educational background.

- Professional Background: Factors such as tenure with current employer, job stability, and overall work experience are evaluated.

- CIBIL Score: A minimum CIBIL score of 650 is required to qualify for a loan.

- Loan Purpose Verification: Ensuring the authenticity and validity of the loan purpose.

Your Loan Application may be Declined if:

- Misrepresentation of Financial Information: Providing inaccurate details regarding income and financial obligations.

- Overextending Financial Capacity: Applying for an amount that exceeds your ability to comfortably repay.

- Poor Credit History: Inadequate past repayment track record or credit history.

Ensuring Security and Privacy:

At ClikFin, safeguarding your privacy and data security is our foremost commitment. Our advanced technology adheres rigorously to mandated security standards and robust protocols, rigorously tested and certified for enhanced protection.

- No virus

- No advertising

- User protection

Information

- File size: 5.35 M

- Language: English

- Latest Version: v3.10.6

- Requirements: Android

- Votes: 100

- Package ID: com.clikfin.clikfinapplication

- Developer: ClikFin

Screenshots

Explore More

Explore the world without leaving your phone! These top-rated travel apps make planning adventures easy and affordable. Find flights and hotels, get maps and guides for cities, learn useful phrases or read insights from locals. Now enjoy armchair sightseeing or turn upcoming trips into reality. Download your passport to global discovery - with premium features free, your next expedition starts here!

Etransport

Learn German Fast: Course

Horaires Me ! (Paris)

Marcel | VTC | Chauffeur Privé

Compare rideshares & taxis

기차여행

TalkMate

Screen and Photo Translator

Comment